BKV to buy ExxonMobil’s Barnett assets for $750 million

On May 19, 2022, ExxonMobil agreed to sell its Barnet Shale production and midstream assets to BKV Corporation. Closing by end of June, the offer includes $750 million plus extra compensation depending on future gas prices.

According to its press release, the sale is part of a wider portfolio rationalization for ExxonMobil. The company got the properties though its 2020 XTO Energy acquisition. It now has no further development investment planned for the Barnett Shale.

Using our environmental data analytics tool, we investigate the environmental impact of the transaction with a focus on unplugged inactive wells. The deal is ESG-accretive to BKV, as it doesn’t increase the company’s percentage of inactive wells or the average associated inactive years. But, ExxonMobil was more actively plugging wells in the basin.

Can BKV maintain the pace? What does company plugging history in the basin suggest?

ESG Dynamics offers A&D advisory services to our clients to increase the ESG-accretive nature of on oil and gas transactions. Empowered by our environmental data analytics, we assist sellers to prepare their properties for market and help buyers find assets that meet their ESG goals.

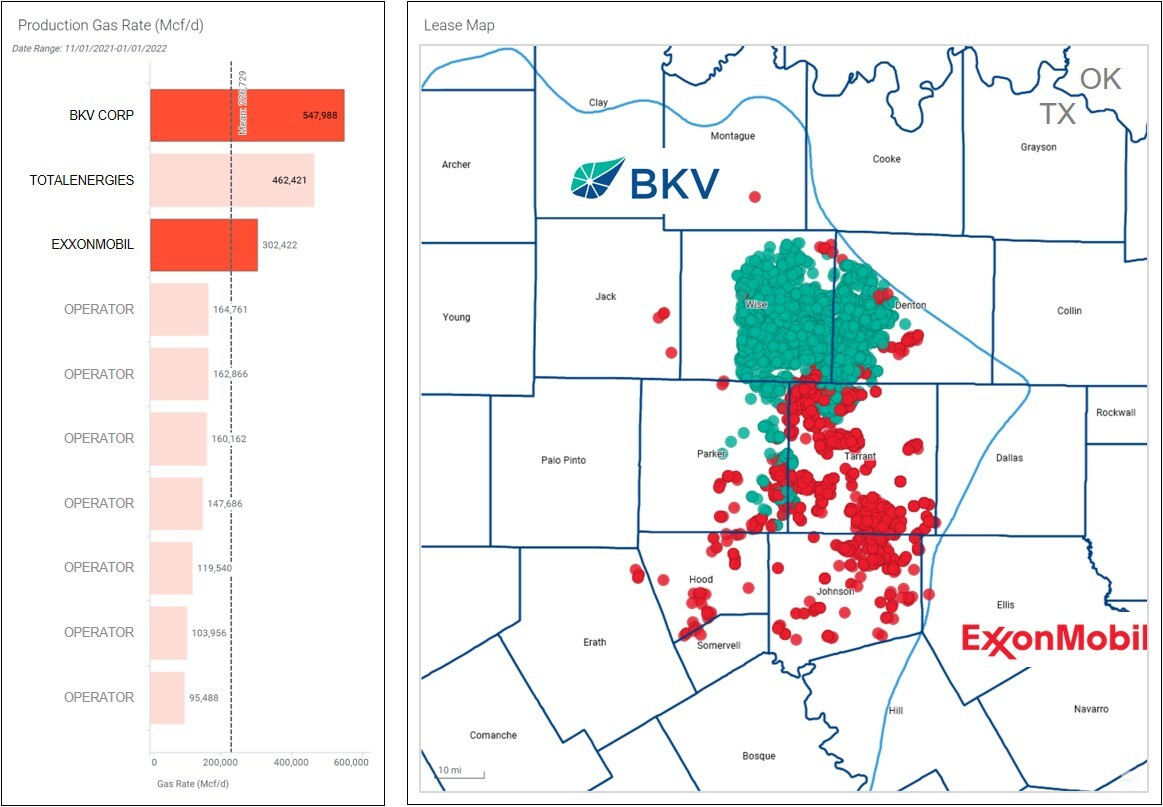

A Distinct Barnett production leader

BKV will account for over 30% of all Barnett gas production with the ExxonMobil asset acquisition. The combined operated gas production of 850 MMcf/d furthers BKV’s Barnett dominance, ahead of its closest competitor, TotalEnergies.

BKV acts as a consolidator in the basin with this second deal, close on the heels of its 2020 Devon Energy asset acquisition. The new properties extend BKV’s footprint across the basin, reaching south into prolific Tarrant and Johnson Counties.

Old assets, inactive wells

The Barnett Shale is the oldest successful unconventional play in the US onshore. Mitchell Energy originally drilled the wells that BKV now operates. Some date back 40 years, but most horizontal drilling occurred since 2001, with the advent of hydraulic fracturing.

The Barnett play contains 52,000 wells, more than 20% in the unplugged inactive category. These wells no longer produce, but still await proper plugging and abandonment to prevent potential environmental hazards.

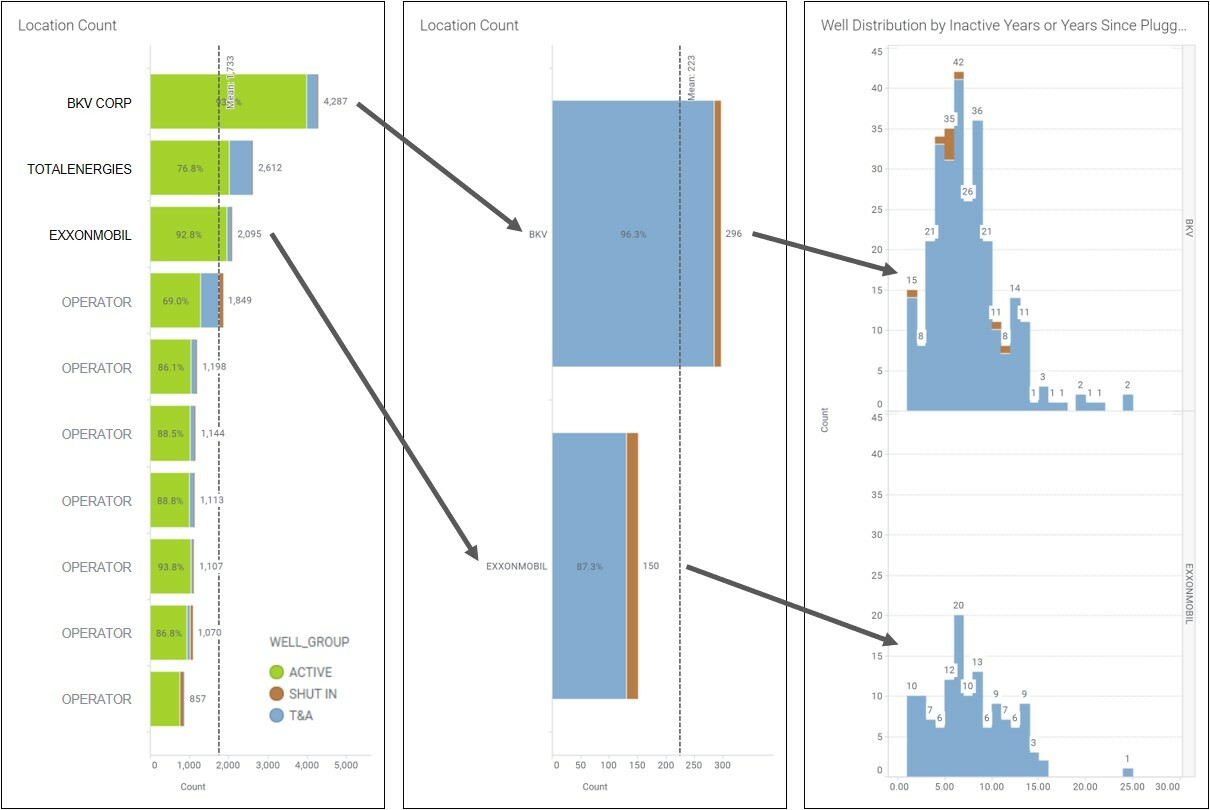

BKV consolidation yields total well fund of over 6,300 wells

BKV will gain more than 2,000 wells from ExxonMobil in the Barnett, bringing the total well fund to over 6,300 wells. Both the base BKV asset (legacy Devon Energy) and the new acquisition have inactive wells in the portfolio, the majority of which are temporarily abandoned (T&A).

Both assets include about 7% inactive wells relative to the total well fund, better than the basin average of 20%. They also show similar inactive years distributions.

The combined asset accounts for 3.7% of the Barnett total inactive well fund, while delivering a third of the basin’s gas production.

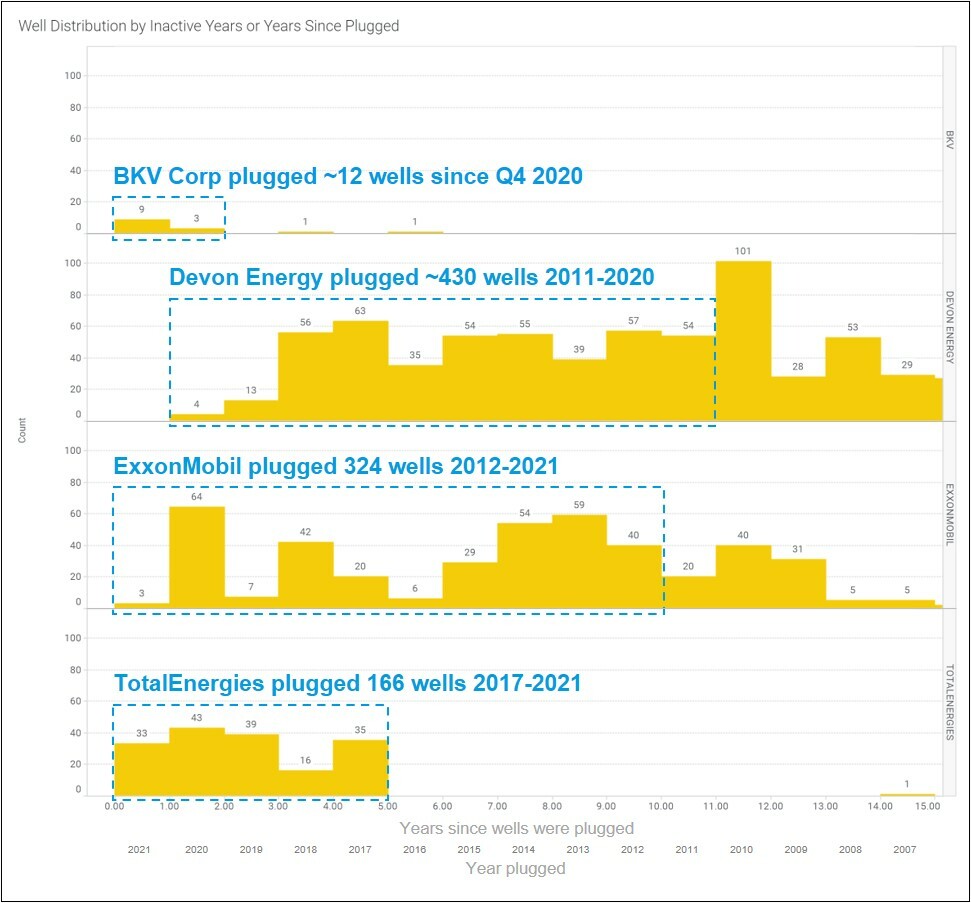

Barnett plugged & abandoned well records by operator

Prior to the divestiture, Devon Energy had been active in plugging its inactive Barnett wells at an average annual pace of more than 40 wells/year (from 2011-2020). Since taking over in October 2020, BKV plugged only 12 wells. With 296 available inactive wells, this plugging rate of 6 wells/year leads to a 49-year abandonment program. Further acceleration will be required.

ExxonMobil, over the past 10 years, plugged an average of 32 wells per year. At this pace, the remaining inventory of 150 inactive wells could be plugged in 5-years.

BKV did not outline plans for plugging and abandoning old wells in its 2021 sustainability report, where it ranks greenhouse gas (GHG) emissions as the most material ESG issue.

Though the deal is ESG-accretive to BKV, the company’s pace of plugging inactive wells will determine whether the deal is ESG-accretive to the public.

More ESG insights on the transaction

Unlike other private oil and gas companies, BKV voluntarily published its first sustainability report in 2021. ExxonMobil touted BKV’s net zero greenhouse gas emissions target for the sold properties. Planned emissions reductions activities include equipment retrofits, leak detection, electrification with renewable energy sources.

The ExxonMobil deal also brings a midstream component, which contributes half of its Barnett GHG emissions, almost all from combustion equipment according to our ESG data. Reducing that impact represents a new challenge for BKV, which currently only has production operations.

With the new dominant basin position, BKV also plans to pursue carbon capture and sequestration (CCS). In early June, the company announced a partnership with EnLink Midstream to capture and compress associated carbon dioxide produced with Barnett Shale gas, for underground disposal.

(article updated 6/10/2022)

Get our take on your next deal

Contact us at info@esg-dynamics.com to learn about our oil and gas Environmental Advisory Practice. Or ask to see our environmental data analytics platform in action. We’re here to help with environmental compliance and environmental benchmarking, to quickly identify concerns so you’ll be ready for upcoming deals, capital raise or ESG messaging.