On March 21, 2022, the Securities Exchange Commission proposed new climate-related disclosure requirements, to strengthen and standardize disclosures encouraged by its earlier 2010 guidance. Companies would start reporting climate-related risks along with greenhouse gas (GHG) emissions as early as fiscal year 2023. The extended public comment period closes June 17, 2022.

Essential elements of the proposal

As anticipated, the new proposal draws from the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and the GHG Protocol standards. Thus, the proposal focuses heavily on physical and energy transition risk management. Many oil and gas companies already use the TCFD framework, which may ease implementation of the proposed recommendations.

Under the proposal, climate-related disclosures would be included in registration statements and annual reports (10-K) alongside financial data. GHG data and qualitative discussion similar to MD&A would form a new section of the 10-K. Both text and numerical data will be tagged electronically.

Investors have been calling for more transparent and consistent climate-related disclosures, to compare across companies. Currently that information may be scattered among websites, annual reports or sustainability reports, using different methodologies and metrics.

Risks, Strategy and Governance

Climate-related risks must be disclosed if they materially impact the business, its strategy, outlook or financial outcomes. Impacts could include physical damage to operations from severe weather events (a physical risk) or lost revenue as customers shift to cleaner energy types (a transition risk). Importantly, SEC seeks to understand how companies detect and address climate-related threats and opportunities within the overall risk management process.

Governance carries weight in the proposal too. Companies should describe how the board and managers oversee climate-related risk analysis and responses.

If firms set climate-related targets, those transition plans must be outlined including intermediate steps to attain long-term aspirational goals. The proposal requires disclosure of any carbon offsets, internal carbon price and scenario models.

Greenhouse Gas Emissions

Under the proposal, all companies would disclose Scope 1 and 2 GHG emissions – those generated directly by company-controlled sources and indirectly through energy, heat or cooling purchases. Reports should distinguish emissions by both scope and gas type. Emissions must be stated before any carbon offsets, along with an indication of intensity relative to production. The initial estimates may be unvetted, but require limited independent assurance in year two reaching reasonable assurance two years later.

Scope 3 emissions disclosure drew much debate during the SEC discussions, because they are more difficult to estimate. For oil and gas producers, this represents the bulk of total GHG emissions. As proposed, Scope 3 emissions reporting would be required in certain cases for larger firms beginning in 2025:

• if the emissions are material

• if relevant targets, such as Net Zero goals, are stated

Assurance would not be required for these estimates, and safe harbor terms apply. Smaller reporting companies need not disclose Scope 3 emissions.

When the new rules take effect

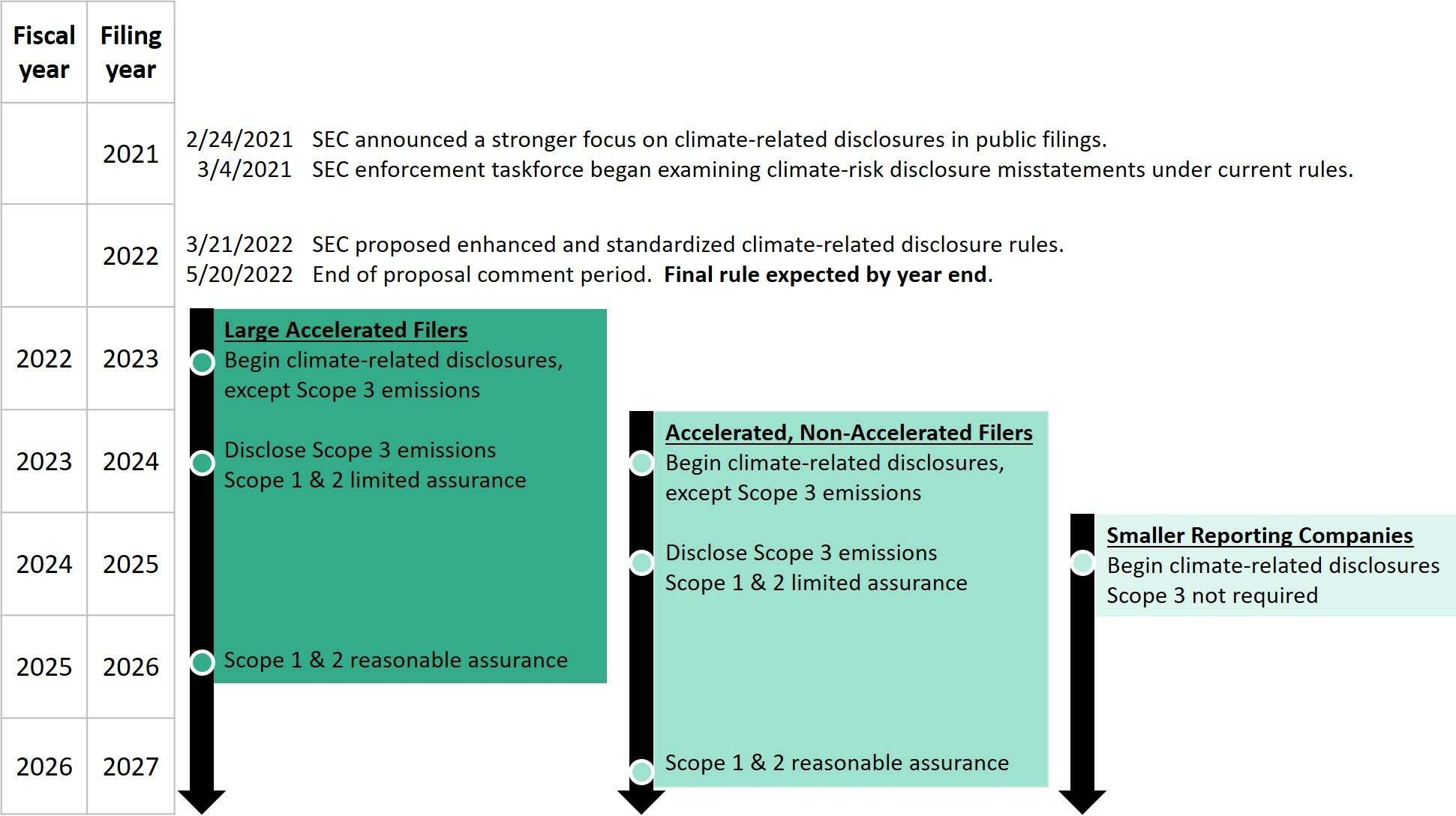

The proposal will remain open for public comment until at least May 20. The SEC will likely need 6 months to review and address the millions of comments expected. A finalized rule is anticipated by year end 2022.

Disclosure requirements would apply in phases, depending on the company’s filing status, beginning as early as fiscal year 2023 for large accelerated filers. Scope 3 emissions reporting would lag by one year. Limited attestation of Scope 1 and 2 emissions also begins in 2024, reaching reasonable assurance in two years as data confidence builds. Smaller reporting companies would have an additional preparation time, beginning disclosures by 2025.

Potential court challenges to the new rule could delay or even cancel its implementation.

Preparing for SEC climate-related disclosures

While many oil and gas companies are familiar with the TCFD framework, some may be concerned about the SEC proposal details. Our experts can assist in preparing regulatory proposal feedback during the public comment period.

Although changes may be seen in the final SEC rule, the direction of travel is clear. Investors seek standardized, accurate, and decision useful information about climate-related risks to corporate performance. The phased approach allows companies to establish risk management programs and begin gathering necessary data.

Especially for oil and gas companies, now is the time to assess current climate-related reporting processes and prepare for GHG emissions data collection. ESG Dynamics can help evaluate the completeness and consistency of current disclosures across regulatory agencies. Our unique emissions database reveals environmental blind spots and benchmarks performance relative to peers. We can conduct a Health Check of your current processes, and help develop a plan so you’ll be fully ready to meet the coming SEC disclosure requirements.

Here’s a link to the full SEC proposal (warning it’s almost 500 pages long!)