EXPERT ENVIRONMENTAL ADVISORY FOR OIL & GAS

Maximizing performance with data analytics-driven due diligence, intelligence reports, and expert advisory.

Our deep industry expertise and innovative approach to analyzing oil & gas environmental data provide our clients with the intelligence to rapidly assess the environmental performance of oil and gas assets, companies, or basins, streamline benchmarking, improve regulatory compliance, identify the highest impact opportunities, and inform investment decisions.

Environmental advisory for oil & gas

As the spotlight on environmental risks and liabilities associated with oil and gas operations intensifies, businesses are facing mounting pressure from stakeholders to take action. To help navigate this challenging landscape, our Environmental Advisory Practice offers expert guidance and support. By leveraging our extensive data from public sources, we provide valuable insights to conduct regulatory compliance assessments, performance benchmarking, and uncover unique opportunities for improvement. If you're looking to rise to the challenge and demonstrate your commitment to environmental stewardship, engage our team today to kickstart your journey.

Health Check

Take charge of your environmental and regulatory challenges with confidence. Stay ahead of potential risks and avoid unexpected inquiries from stakeholders, media, or regulators. Our cutting-edge Health Check product is crafted to help our clients establish a baseline via a regulatory compliance review, evaluation of environmental performance, trend analysis, and peer benchmarking. Our insights, rooted in real data, minimize liabilities and legal risks while supporting environmental impact reduction.

A&D environmental due diligence

Through advanced automation tools, data analytics capabilities, and a team of seasoned experts, we have optimized every stage of the due diligence process. This includes rapid data collection, efficient analysis of regulatory filings, and precise risk assessment methodologies. The reduction in time and costs allows companies to focus on strategic priorities, such as mitigating risks, maximizing compliance, and boosting value from acquisitions, while, where appropriate, having the capability and optionality to conduct our assessments pre-PSA. Contact us today to learn more about our due diligence services.

Intelligence reports

Experience the powerful insights of our intelligence reports, tailored to your company or basin-specific needs. Our reports are rich with insights from diverse datasets, including state and federal sources, and can be customized for a comprehensive understanding of environmental trends relevant to your operations or investment portfolio. What sets us apart is our team’s deep industry expertise in oil and gas sub-surface, operations, oilfield services, regulatory, finance, environmental remediation, and due diligence. We integrate proprietary metrics for actionable insights into company or basin-level environmental and emissions performance. Moreover, we bring our knowledge of specific basins and insights from active engagement in the A&D market, further enhancing value of our reports. Choose us for tailored reports that set you apart and lead to strategic success.

Blog

Revolutionizing Oil And Gas Environmental Due Diligence With ESG Dynamics

Editorial Team

March 27, 2024

How is ESG Dynamics reshaping environmental due diligence? In the fast-paced world of oil and gas acquisitions, environmental due diligence is a critical step to assess

CrownRock: 2022 Upstream GHG IQ Report

Editorial Team

December 11, 2023

Occidental Petroleum (OXY) to buy pure-play Permian producer CrownRock for $12 billion. CrownQuest is the parent company of CrownRock. The pure-play Permian operator continued to

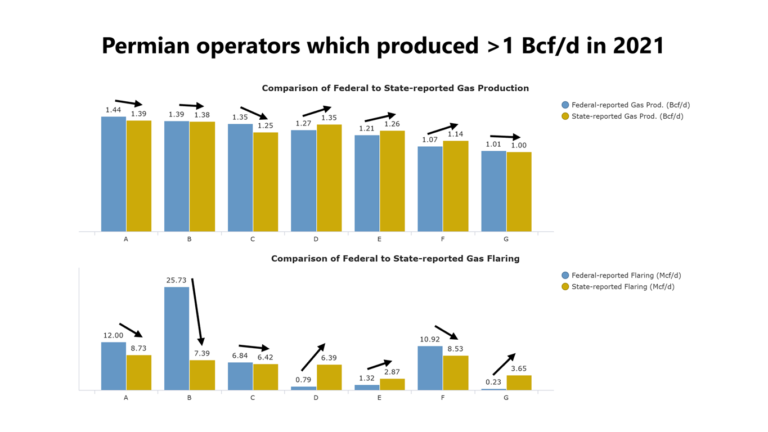

Comparison of Large Permian Gas Producers’ Reported Flaring to Federal and State Regulators

Editorial Team

July 10, 2023

📈 Analysis comparing Permian Basin operators producing over 1 Bcf/d in 2021 revealed that while the reporting of production to federal and state regulatory bodies