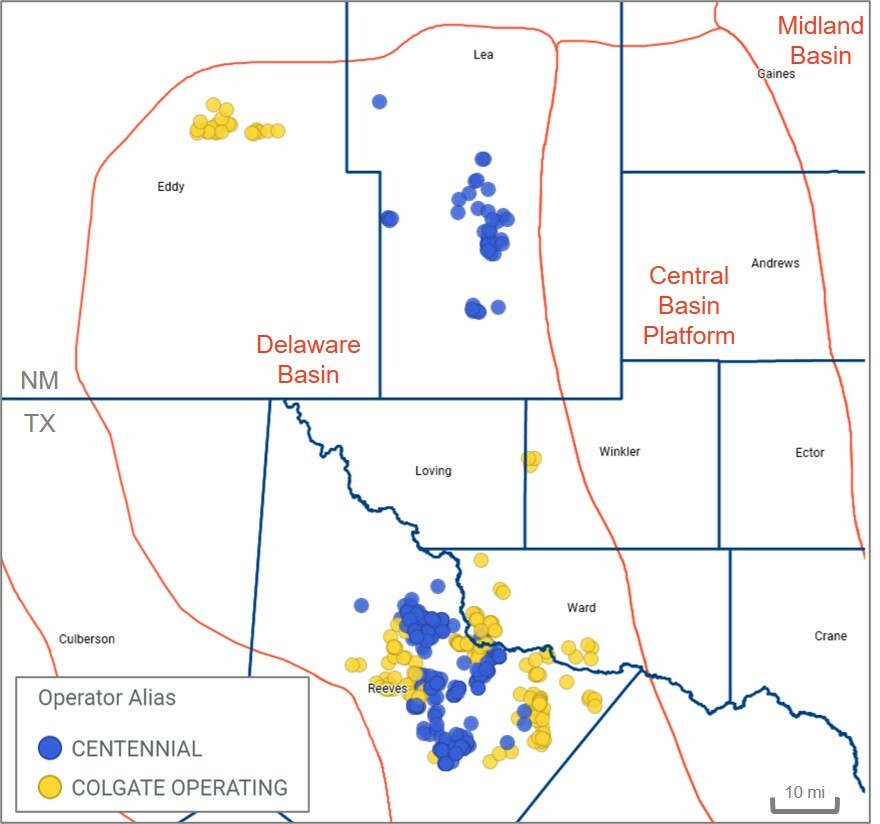

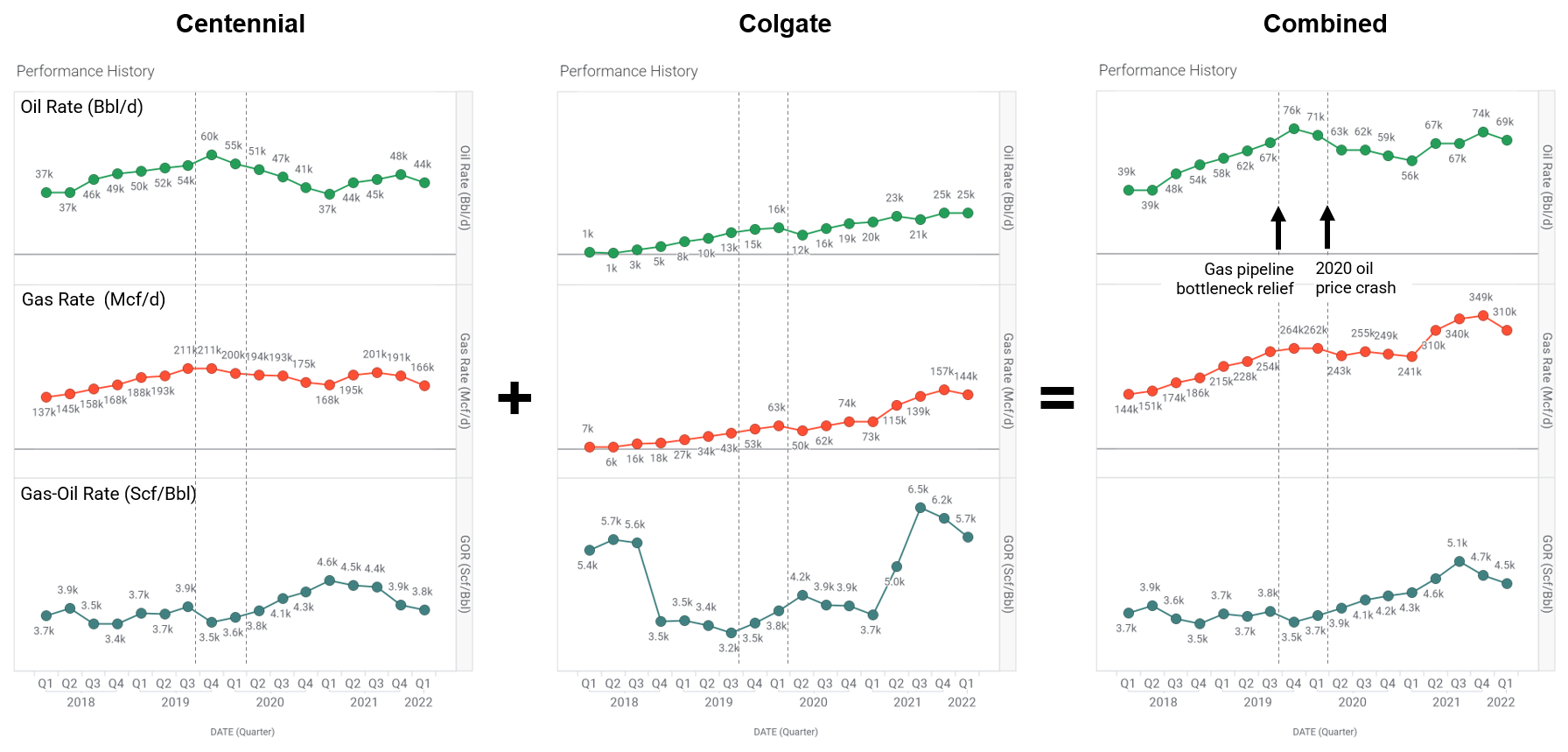

Centennial Resource Development and Colgate Energy plan to merge, becoming the largest pure-play Delaware Basin oil and gas company, valued at $7 billion. The stock market responded positively to the May 19th announcement. Centennial’s stock price quickly reversed a month-long dip, up 47% over two weeks. The press release labeled this “a merger of equals”.

Beyond financials, the deal joins two compatible operators from an ESG perspective too. Centennial emphasized the new company’s ESG focus throughout its investor presentation. Our analysis shows that both companies have reduced flaring emissions over the past two years. Fewer inactive wells sit unplugged compared to other top producers in the basin. Yet, oil spills have increased since 2018. Environmental regulatory reporting appears incomplete and data inconsistencies remain across various public sources. Will bigger be better when it comes to ESG performance?

ESG Dynamics’ Health Check is designed for operators like Centennial and Colgate, to benchmark environmental performance and identify compliance gaps or violations before an asset transaction draws a spotlight. By identifying and resolving issues early, companies can attract new assets and funding or sell to ESG-minded buyers.

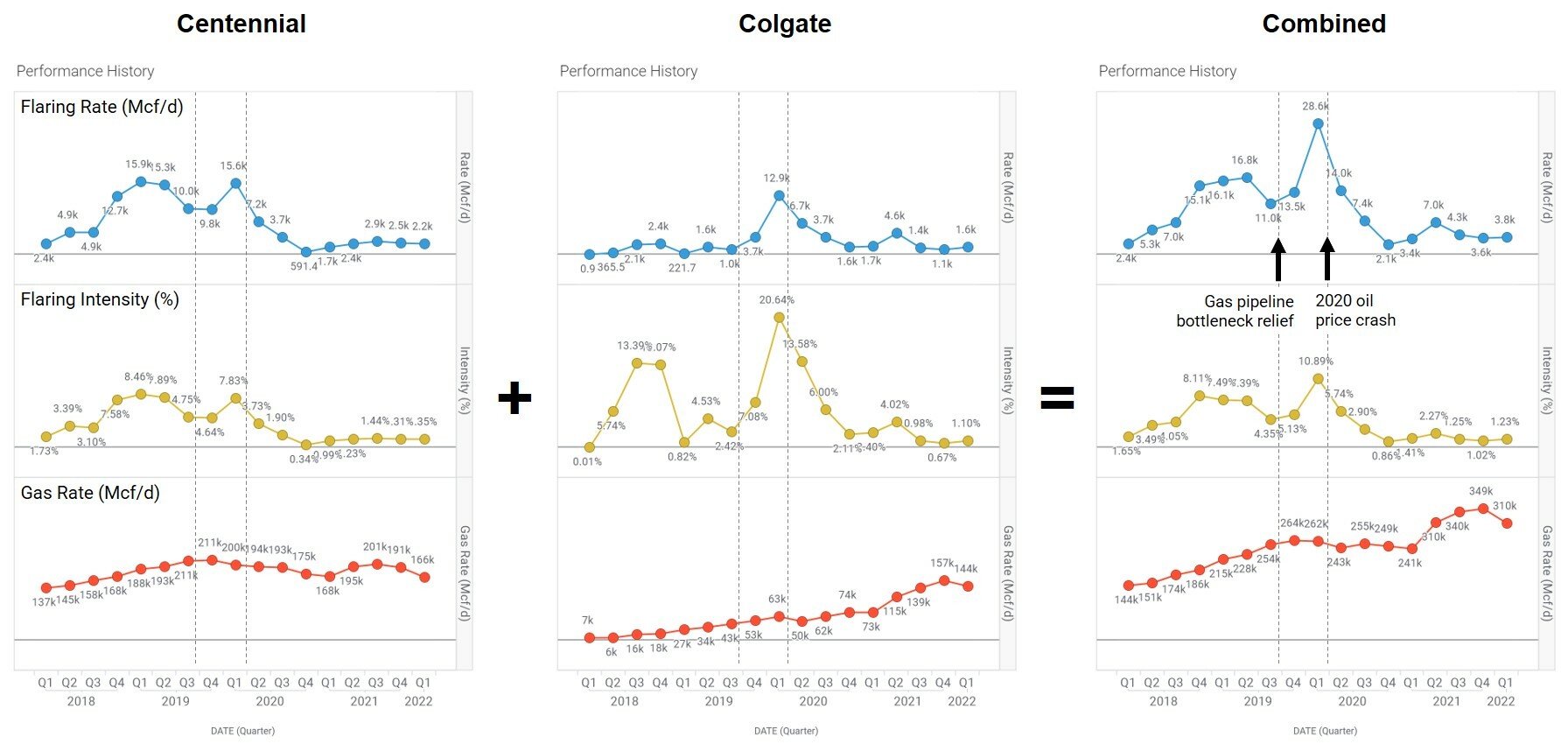

Gas flaring intensity

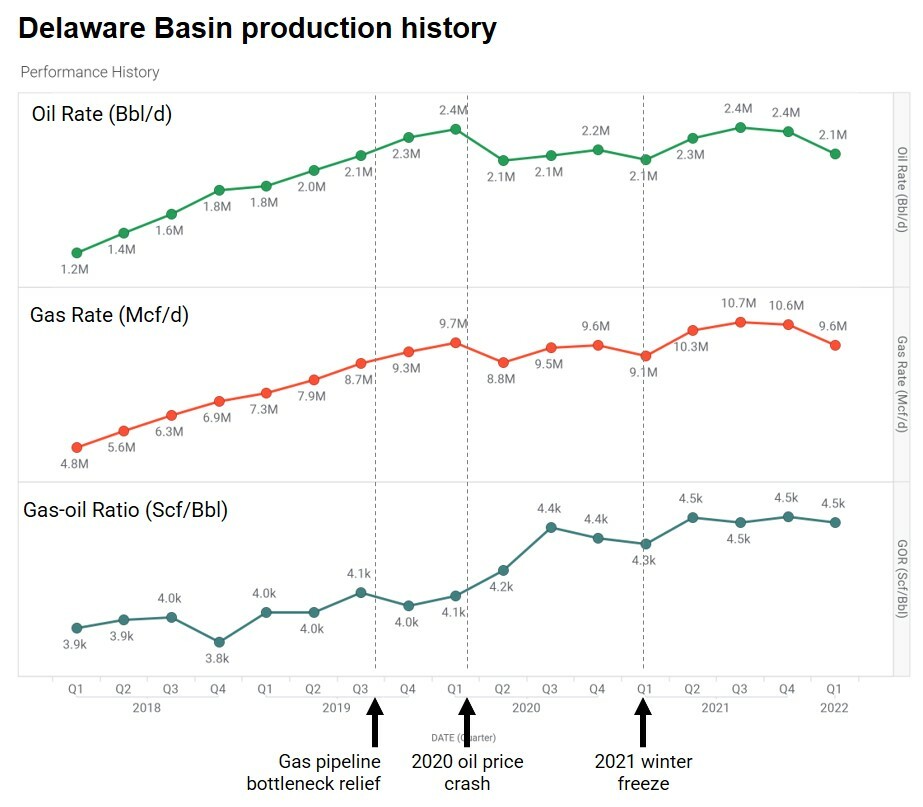

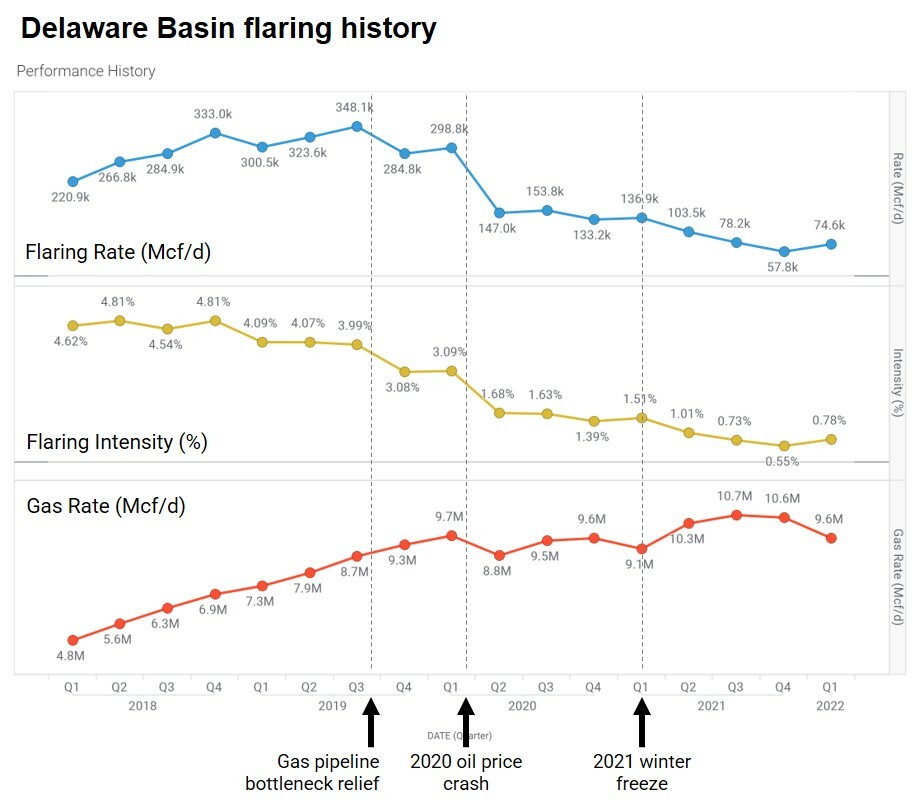

Centennial and Colgate flaring levels have generally followed regional patterns. Delaware Basin flaring rates rose from 2017 to mid-2019 as increasing drilling and completion activity and rising gas-oil ratio filled exceeded pipeline capacity. Flaring peaked in June 2019 at 389.6 MMcf/d, nearly 5% of produced gas. Centennial was burning 15.3 MMcf/d then, a 7.9% flaring intensity.

By September 2019, the addition of the Gulf Coast Express and other pipelines eased the bottleneck, relieving routine flaring by 30%. Activity cuts on extremely low 2020 oil prices further reduced flaring by 40% that year. Since Nov 2020, flaring stayed low across the Delaware Basin despite recovering rig activity. Year end 2021 flaring reached a low of 52 MMcf/d and averaged less than 1% intensity, 83% lower than pre-pandemic rates. Regionally, Permian Basin flaring intensity fell from 4.8% at year end 2018 to 1.4% in early 2022, corresponding with increased gas production.

Centennial severely curtailed production in 2020, shutting in wells and laying down all rigs for several months. Oil production fell 40% throughout the year to 2018 levels, and has yet to fully recover. Both flared volumes and rate also dropped sharply. The company cut flaring intensity more than 95%, matching the basin average 0.75% in January 2022.

As a newer operator, Colgate’s flaring history also reflects asset acquisitions, along with regional pressures. With nearly continuous production growth, flaring intensity peaked in Feb 2020 at 30% of produced gas, or 19.5 MMcf/d flared volumes. The operator cut that to 6% a year later. Colgate continued to reduce flaring intensity to align with the basin average at 0.75% by year end 2022, positioning itself to attract buyers.

Oil spills

Oil spill events and volumes have increased since 2017 in Centennial operations, according to its 2021 sustainability report. Public data suggests that larger spills dominantly occur at tank batteries, caused by equipment failure. Centennial notes that it uses root-cause analysis to prevent future spills. No spill data was found for Colgate operations.

Centennial’s sustainability report doesn’t compare directly with spills reported to the Texas Railroad Commission (TRRC), due to data inconsistencies and different minimum volume thresholds for the two reports. Investors and other stakeholders commonly face these types of data challenges when evaluating ESG reports. Consistency matters as ESG disclosures gain attention, particularly under coming SEC requirements.

ESG Dynamics offers environmental data and compliance audits to quickly assess whether oil and gas companies are reporting environmental data & metrics consistently to the public. Our Health Check advisory service and oil & gas environmental analytics platform unite data from diverse sources to provide an integrated view of environmental performance.

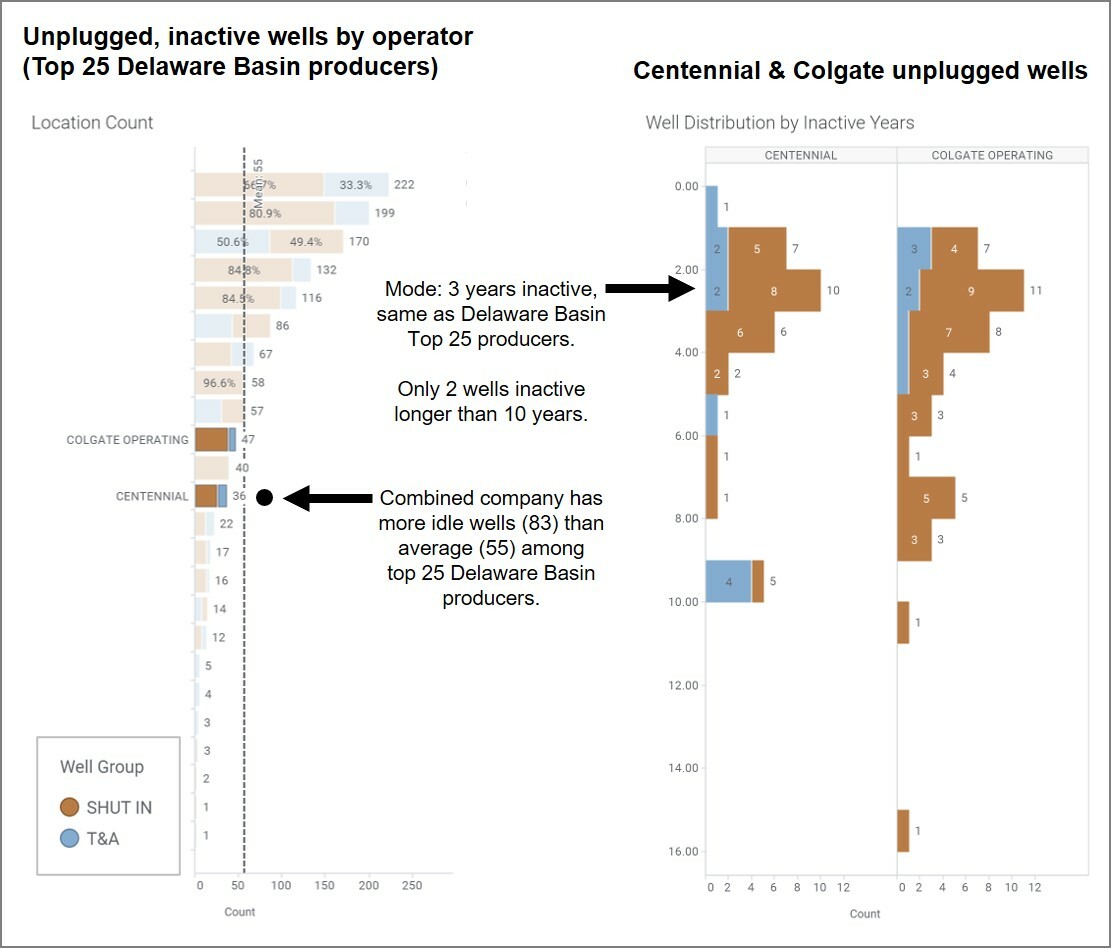

Inactive wells

Centennial and Colgate each keep fewer unplugged inactive wells (36 and 47, respectively) than the top Delaware Basin producers. Together though, the new company will exceed the average (55) if boreholes aren’t returned to production or plugged and abandoned. Of the combined 83 idle wells, most have been inactive less than four years. Only two remain unplugged after 10 years without production. This aligns with basin-wide norms.

The Delaware Basin contains nearly 3,000 non-producing wells, dominantly in Texas. Almost 20% of those remain unplugged after 10 years of inactivity. The largest concentration of Permian Basin inactive wells lies in older oil fields of the Central Basin Platform.

Other environmental issues

Like many small and private oil companies, Centennial and Colgate are in the early days of the sustainability journey. Each published a 2021 sustainability report, though Colgate’s is not publicly available.

The concentration of assets in the Delaware basin makes the new company susceptible to physical risks in the region, like the 2021 winter freeze or drought conditions. Water handling and recycling are critical in this basin where seismicity induced by water disposal is a growing concern.

ESG Dynamics analysis of diverse public oil and gas environmental data suggests both operators have room for improvement on regulatory compliance and data consistency. Both companies should carefully review their filings and data sets – like oil spills, H2S, greenhouse gas and other air emissions – as they work through the merger. New SEC disclosure regulations will raise the profile of any environmental reporting differences for the fully public company.

Learn more

Contact us at info@esg-dynamics.com to learn about our oil and gas Environmental Advisory services. Or ask to see our environmental data analytics platform in action. We’re here to help with environmental compliance and environmental benchmarking, to quickly identify concerns so you’ll be ready for upcoming deals, capital raise or ESG messaging.