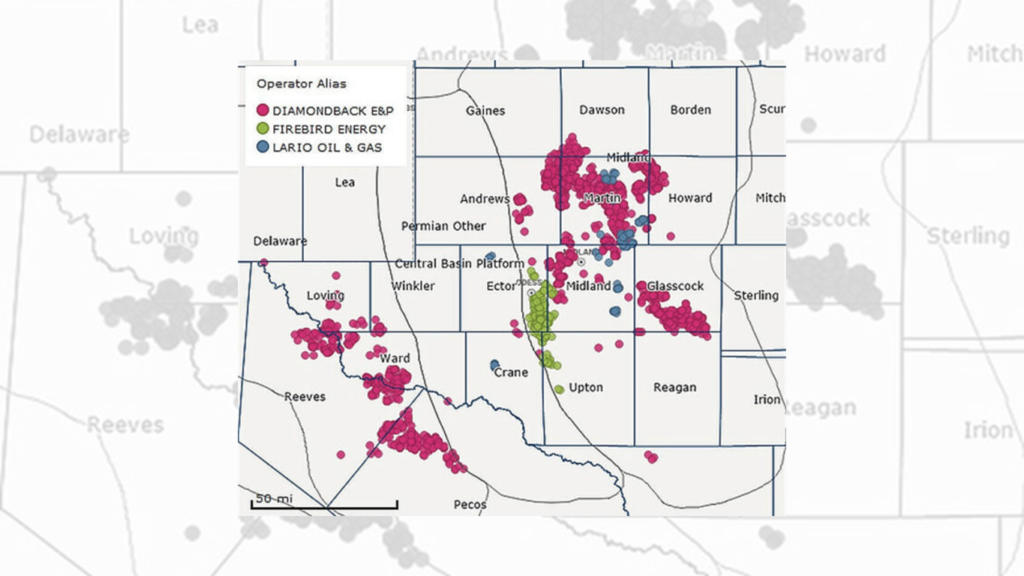

Diamondback Acquires Lario with Unclear Environmental Picture

Diamondback Energy announced yet another Permian acquisition on November 16th. The company agreed to purchase Lario Permian LLC assets focused in the core of the Midland Basin. The century-old family-owned parent company, Lario Oil & Gas, also operates in the Bakken and Mid-Continent. Diamondback offered $1.5 billion in cash and stock for about 25 Mboe/d […]

Diamondback Acquires Lario with Unclear Environmental Picture Read More »