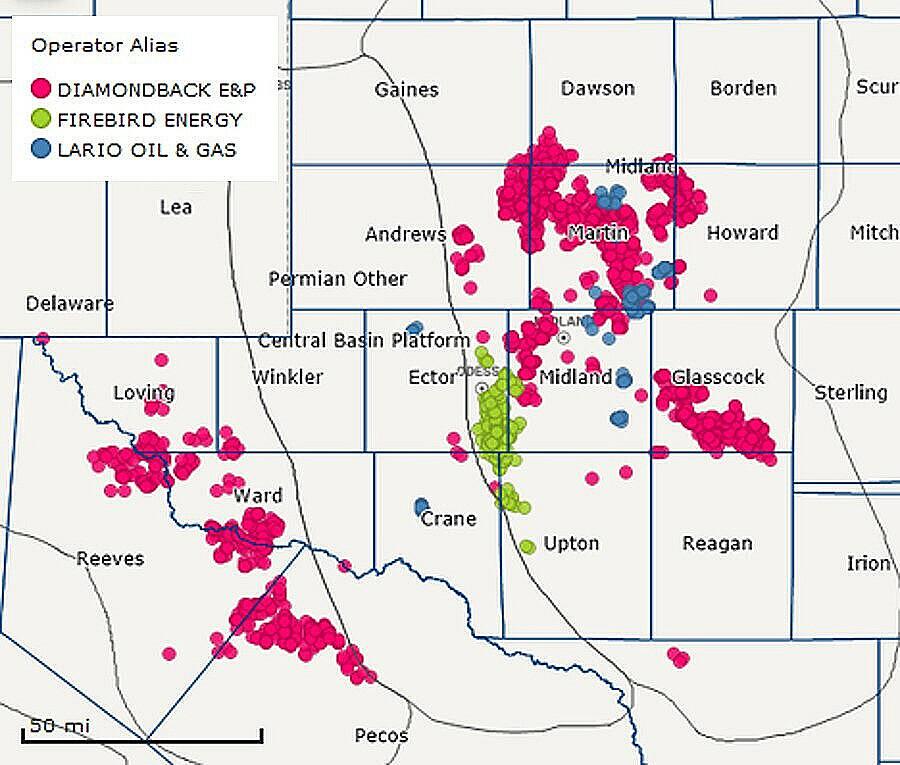

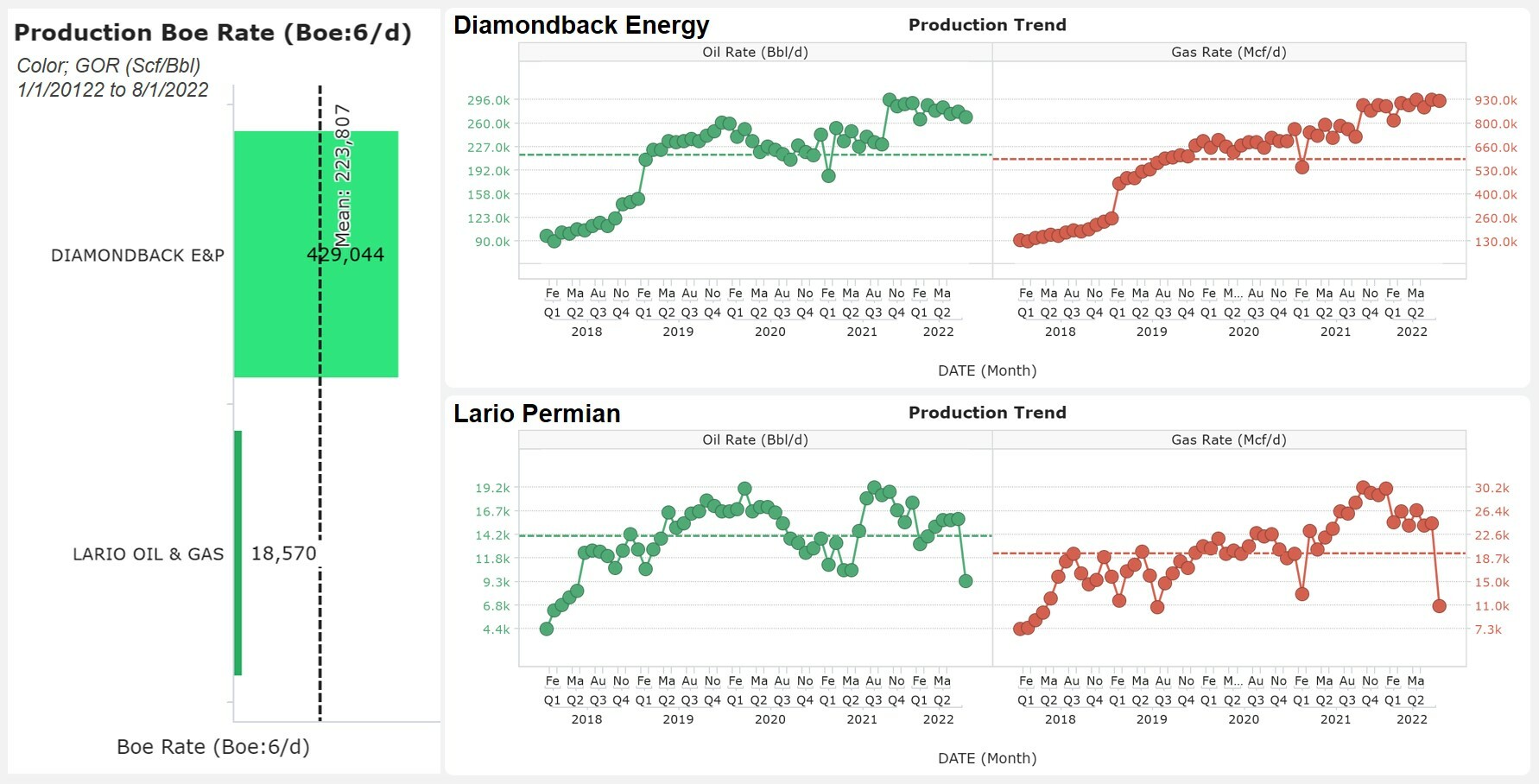

Diamondback Energy announced yet another Permian acquisition on November 16th. The company agreed to purchase Lario Permian LLC assets focused in the core of the Midland Basin. The century-old family-owned parent company, Lario Oil & Gas, also operates in the Bakken and Mid-Continent.

Diamondback offered $1.5 billion in cash and stock for about 25 Mboe/d of production and 25,000 gross acres with potential for 180 well locations. Closing is slated for January 2023.

The announcement comes hot on the heels of Diamondback’s recent FireBird acquisition. In our blog article about that deal, our analysis shows that the new owner faces extra effort to align the properties with its ESG stated targets and reduce FireBird’s high flaring intensity and emissions.

The ESG picture remains unclear for the latest transaction due to limited data on Lario’s performance metrics. This is common among small and private companies, with fewer public disclosure requirements. Yet measurement and reporting underpin ESG progress. Consolidation may improve both transparency and environmental footprint through new operational strategies.

ESG Dynamics helps producers like Lario to evaluate the environmental risks and liabilities that potential buyers check during pre-acquisition due diligence. Our Environmental Due Diligence service audits regulatory compliance and environmental performance leveraging proprietary technology and analytics across a wide range of datasets. Demonstrating strong environmental performance helps sellers realize the full value of their assets.

Unclear environmental footprint

Despite our extensive database, evaluating the environmental component of this acquisition is challenging, because Lario only provides limited environmental data. No data reports on greenhouse gas (GHG) emissions, flaring, fuel gas use, spills or air quality incidents were found from state and federal regulators.

Reliable environmental data lies at the heart of understanding oil and gas related emissions, risks and liabilities. Timely, accurate information helps operators improve performance and reduce potential environmental impacts. Asset buyers use this data to properly evaluate and price properties under consideration. And with growing attention to ESG, investors, lenders, insurers and regulators also seek insight through data reporting.

Greenhouse gas emissions

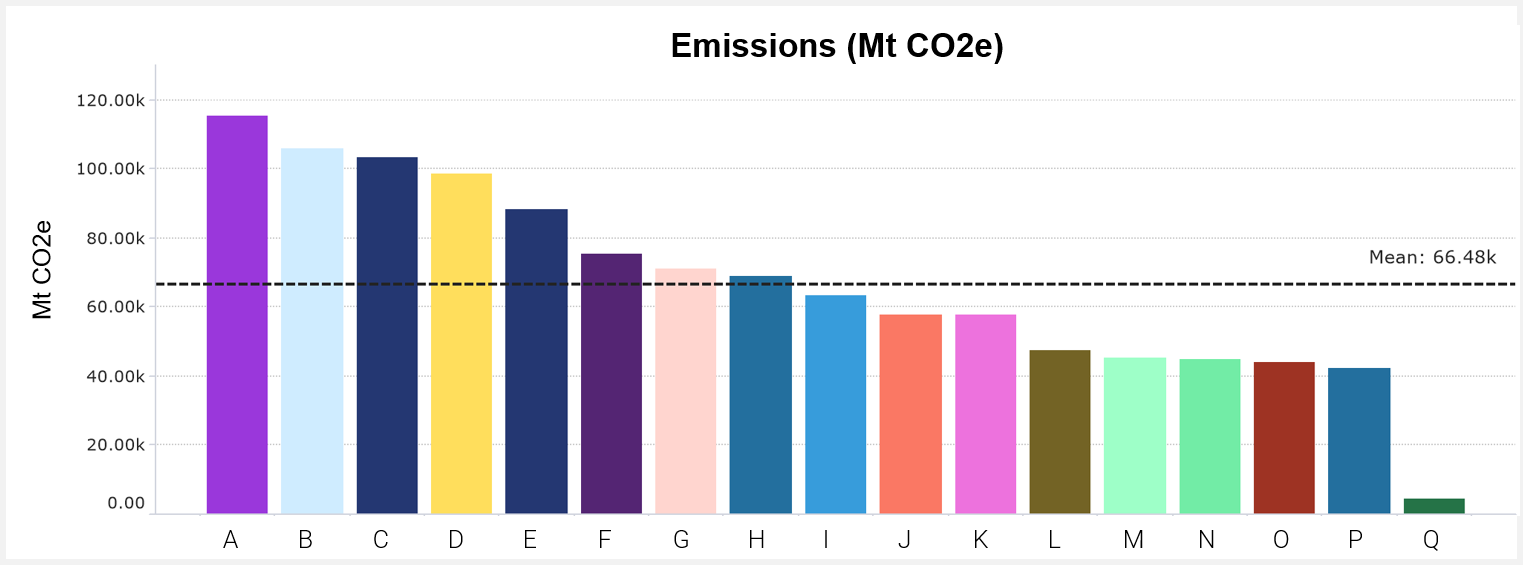

Smaller or private companies often are not subject to extensive public disclosure requirements. The Environmental Protection Agency (EPA) only requires facilities that emit more than 25,000 Mt CO2e annually to report those emissions under the Greenhouse Gas Reporting Program.

Although possible, it would be surprising if Lario fell below the reporting threshold. If so, average production of 19.5 kboe/d implies less than 3.5 kg CO2e/Boe emissions. That would rank among the lowest emissions intensity in the basin, on par with Pioneer, EOG and Chevron. Operators with similar production rates (10 to 20 kboe/d) typically report more than 40 Mt CO2e, averaging 66.5 Mt CO2e and 18 kg CO2e/Boe intensity with 22% methane emissions in 2021. Among these peers, 27% did not report emissions.

Under the Clean Air Act, the EPA may take action against companies that don’t comply with reporting requirements. Ensuring regulatory compliance through data audits is essential to prevent penalties and investigations.

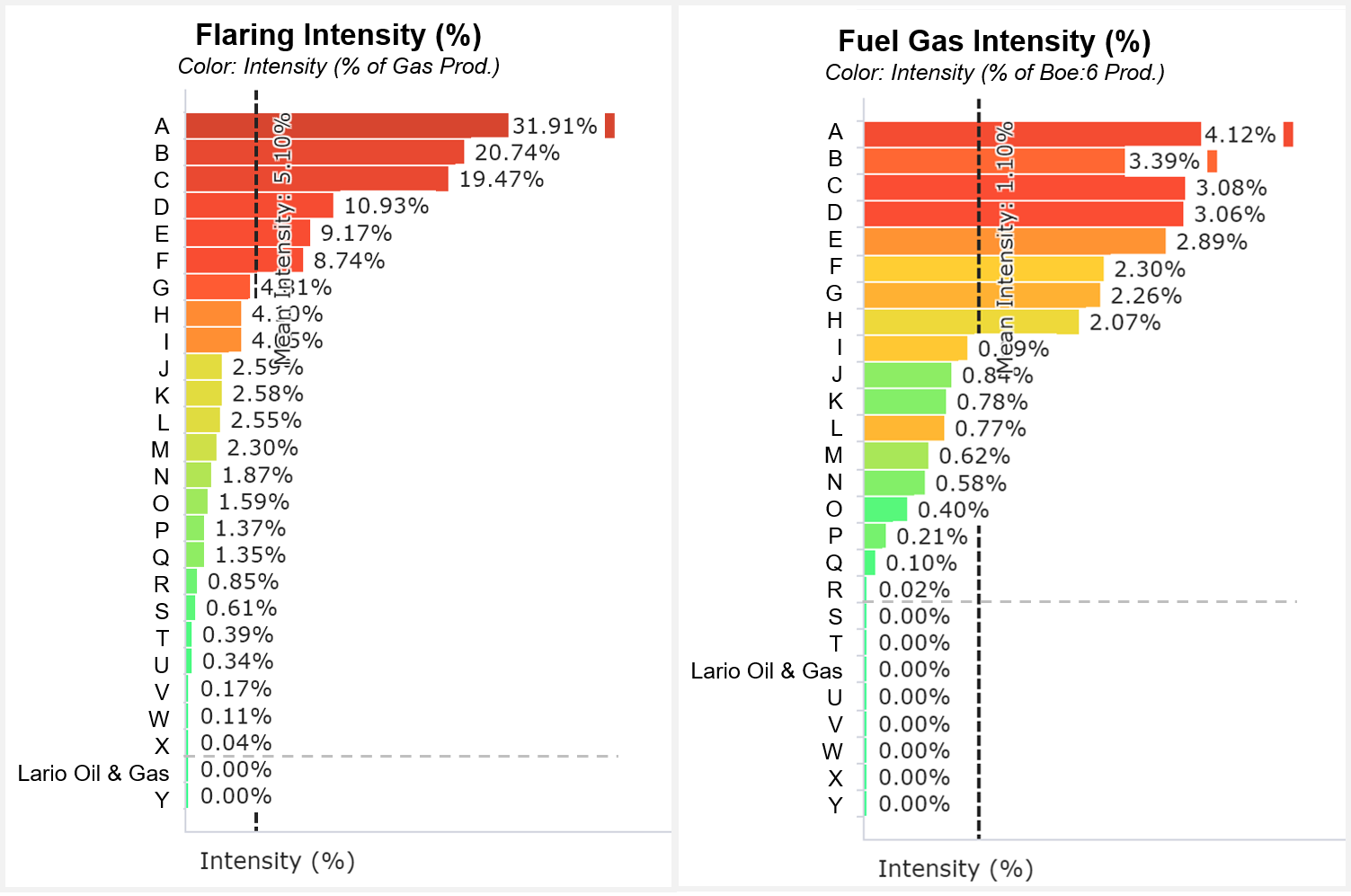

Flaring intensity

Flaring commonly occurs in the core of the Midland Basin, so we suspect that Lario’s zero values for flaring, venting and fuel gas could result from non-reporting. Lario is one of only two comparably-sized companies reporting no flaring over the last five years, out of 26 producers in this bracket. Operators with 10 to 20 kboe/d production flare an average of 1,110 Mcf/d gas at 5.1% intensity. Only 30% of these achieve Diamondback’s target of less than 1% flaring intensity, so it’s possible that Lario flares at levels above that mark.

Searching for clues about performance

Without self-reported data, investors, stakeholders and potential buyers are left to draw their own conclusions about an operator’s environmental impact. They may extrapolate based on hints from other public records such as well status or inspection violations. These sources suggest Lario performs responsibly.

Lario Permian’s assets do not present abandoned well hazards. Lario has only one shut-in well, inactive for just one year. It maintains 99.4% active boreholes compared to Diamondback’s 85% active wells, 17 of which have been shut in more than 10 years.

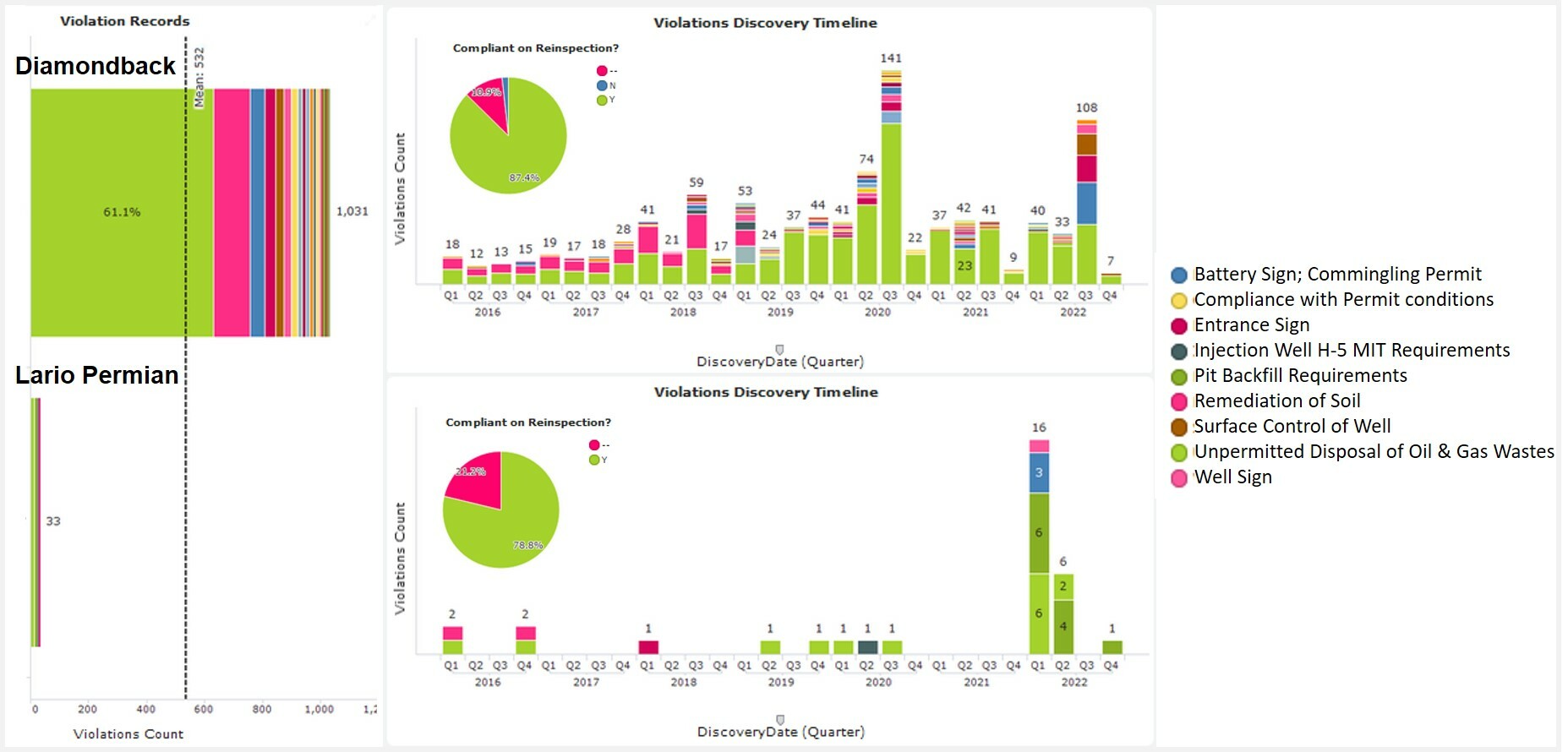

Regulatory inspection records provide independent clues about operator performance. The state files these reports, so they do not rely on company disclosure. Lario receives few inspection violations, though citations for unpermitted oil and gas waste disposal increased in 2022. Since 2016, Diamondback inspections were 6.4% non-compliant, the 5th highest count in the Permian due to scale of operations, but better than the basin average of 9.6%. Those violations dominantly involved unpermitted disposal of oil and gas wastes. Combining the two assets would benefit from improved processes to reduce these waste disposal infractions.

Lower completion emissions

Combining Lario leases into the Diamondback portfolio could improve the future environmental impact through strategic and operational changes.

According to Diamondback’s press release, the new operator intends to reduce drilling activity on the new assets from two rigs to one. Slowing development would reduce greenhouse gas emissions generated during drilling and completion operations. Assuming 16 wells per rig annually (based on Lario’s H1 2022 activity), dropping one rig could eliminate 2,890 Mt CO2e emissions annually. Equally fewer completions would cut another 5,820 Mt CO2e per year, based on Lario’s techniques.

ESG benefits of consolidation

When assets move from private to public companies, transparency on ESG – especially environmental performance – should increase. Some sellers opt to address problem operations and resolve reporting gaps before marketing assets, to strengthen their position. Larger operators may cut emissions with optimized rig lines and stricter controls to meet stated targets.

Emissions from smaller facilities below reporting thresholds become subject to EPA oversight when consolidated into larger operations. State-level environmental data, like flaring and spills, should merge into the acquirer’s broader regulatory practices. Moreover, the assets would gain new attention under the public firm’s ESG initiatives and investor scrutiny.

Get our take on your next deal

Contact us at info@esg-dynamics.com to learn about our oil and gas Environmental Advisory Practice. Or ask to see our environmental data analytics platform in action. We’re here to help with environmental compliance and environmental benchmarking, to quickly identify concerns so you’ll be ready for upcoming deals, capital raise or ESG messaging.