Why is environmental data important?

Reliable environmental data lies at the heart of understanding oil and gas related emissions, risks and liabilities. Timely, accurate information helps operators improve performance and reduce potential environmental impacts. And with growing attention to environmental, sustainability and governance factors (ESG), investors and regulators also seek transparency through data reporting.

How do oil & gas companies use environmental data?

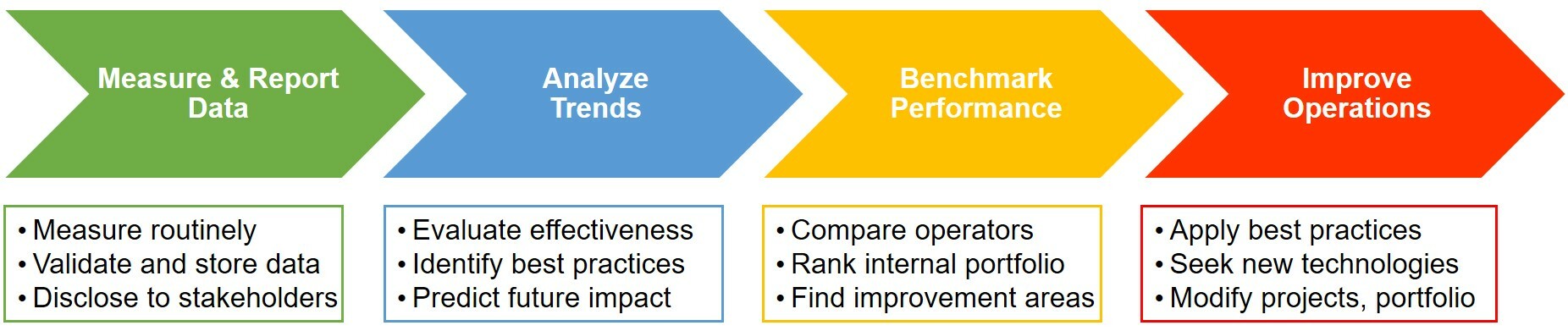

Measure and report

Oil and gas companies use data to self-monitor activities, track and improve performance. Step one requires measuring and collecting environmental data. But that’s just the beginning. Storing, validating and reporting unlock the data’s value.

The oilfield has been criticized for not doing enough to protect the environment. With data, companies can demonstrate the positive steps they’ve taken. Information reporting creates accountability, for both good and bad events.

Analyze and benchmark

Benchmarking environmental metrics within portfolios and among companies reveals trends and best practices. How could an operator determine what environmental strategies work without the underlying data?

To analyze trends and benchmark performance, firms need external and competitor data that supplement their own measurements. Databases of industry metrics allow investigation of:

- company peer group comparisons

- internal portfolio risks and optimization

- regional environmental trends or asset-specific issues

Armed with this information, a firm can evaluate environmental risks to the company in addition to its own impact. Analytic techniques like artificial intelligence and machine learning could help model a company’s forecasted environmental impact. But those tools depend entirely on high quality data.

Improve operations

Environmental data transparency also leads to process improvement, for further accountability. Data analysis reveals environmental best practices, both industry-wide and company-specific. As operators recognize effective strategies, they can establish and modify internal procedures to drive up performance.

Investors and lenders look at benchmarks too, and will question lower-tier environmental metrics. For example, when some companies successfully apply technology to reduce methane emissions, investors will question why others don’t use the same approach. Data allows investors to identify which companies perform better and why they succeed. Public stock and private equity funds can realign their portfolios with environmental stewardship targets. Capital will flow toward best-in-class operators.

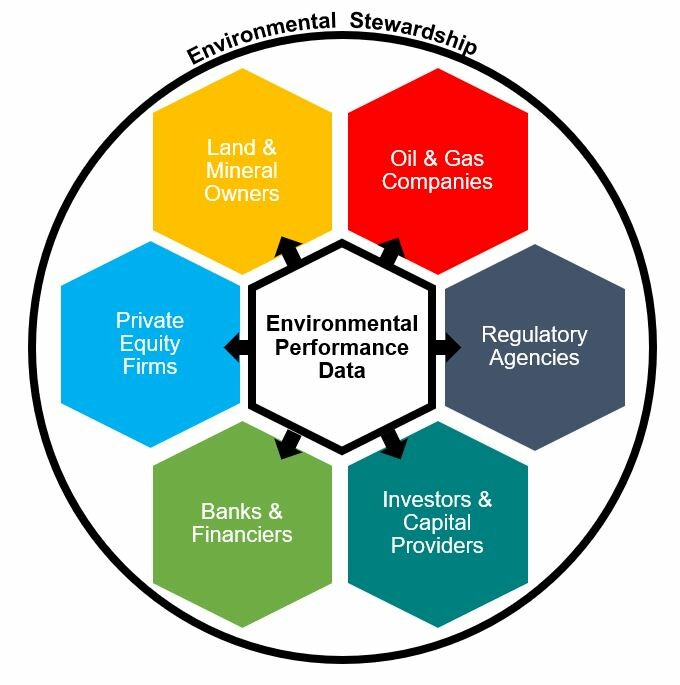

Who else wants data?

Almost every type of oil and gas stakeholder is clamoring for environmental data, each using it for different purposes.

Investors, capital providers, private equity, and banks became interested in non- financial metrics as responsible investing gained traction. Strong environmental performance correlates with overall corporate outcomes like efficiency, better governance and lower credit risk. Financial stakeholders use environmental data:

- to assess the impact of company operations on the environment around it

- to determine ESG ratings for benchmarking investments, companies and sectors

- to understand how a company operates beyond just financial metrics

- to evaluate a company’s sustainability, resilience and performance

- to make investment, lending and credit rating decisions

Land and mineral owners want to protect their property by ensuring they deal with reputable companies. Potential incidents like leaking abandoned wells, saltwater spills or local air pollution present serious concerns for lifestyle and property damage. Environmental performance data equips land owners to create environmental partnerships with oil and gas companies.

A variety of regulators also demand data disclosures. Federal entities, like the Environmental Protection Agency, as well as state governments continue refining reporting requirements. Financial regulators are increasingly focused on data standardization.

- In March 2021, the US Securities and Exchange Commission called for input to develop new climate-related ESG disclosure guidelines.

- The European Union implemented the Sustainable Finance Disclosure Regulation (SFDR) requiring environmental reporting starting in January 2022.

What environmental data is material?

Reporting standards vary…

Many organizations offer different reporting standards. At their core, each of these seek data and measurements. Within the oil industry, the American Petroleum Industry provides a sustainability reporting template. ESG rating agencies traditionally use corporate disclosures, but apply different methodologies and weightings.

…But these metrics are important

While reporting standards continue to evolve and new ratings emerge, several environmental metrics clearly matter for the oil and gas sector.

Greenhouse gas emissions, flaring volumes and intensity top the list, due to the climate impact. Volatile organic compounds releases and other air quality pollutants must be reported, along with liquid spills and leaks. Well status helps identify abandoned wells with potential for subsurface leaks.

Other environmental stewardship metrics include water use, wastewater disposal, and energy consumed during production.