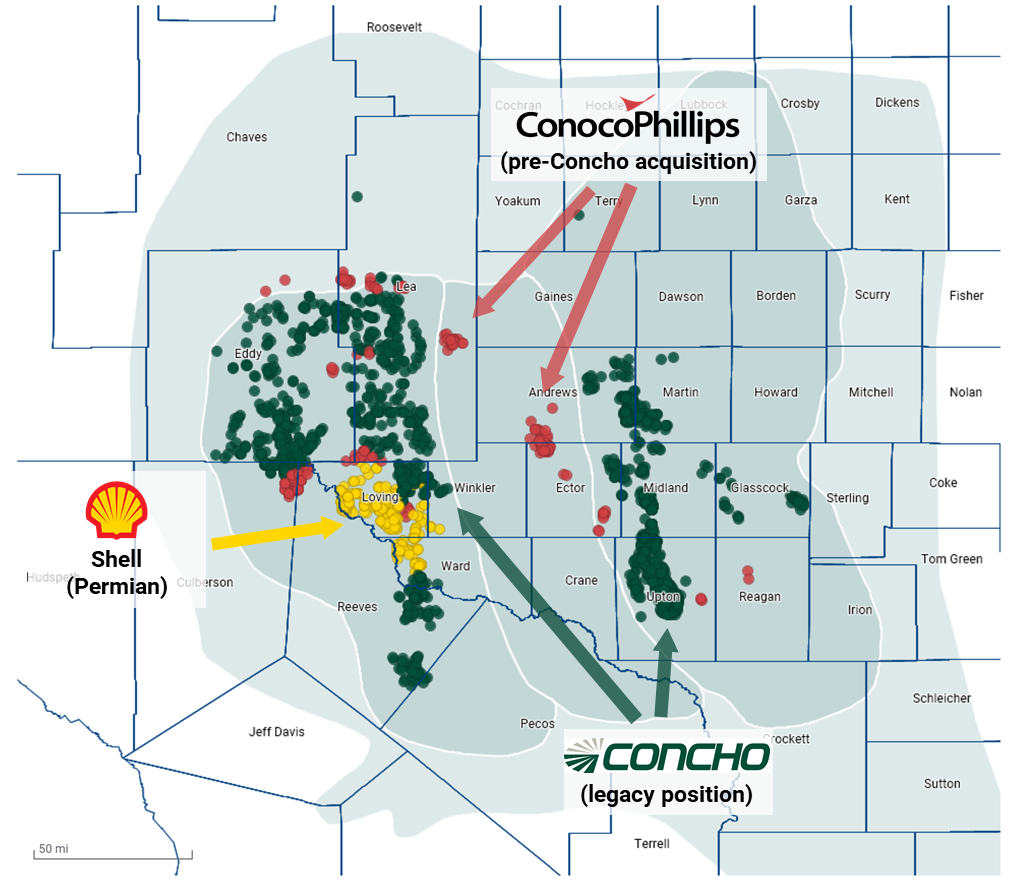

ConocoPhillips acts as a consolidator in the Permian Basin with Concho* and Shell acquisitions

*ConocoPhillips acquired Concho Resources for $9.7 billion in October 2020.

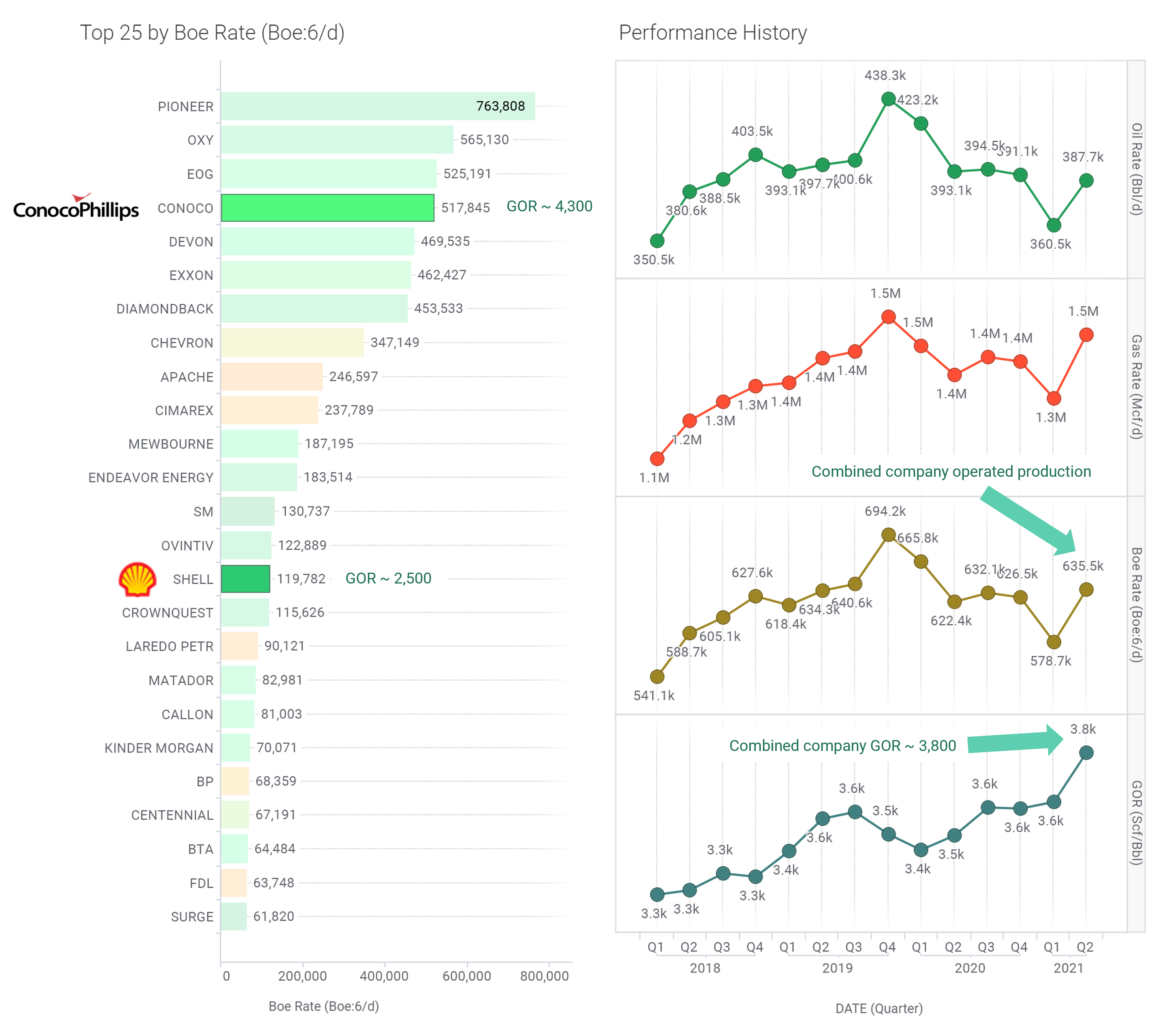

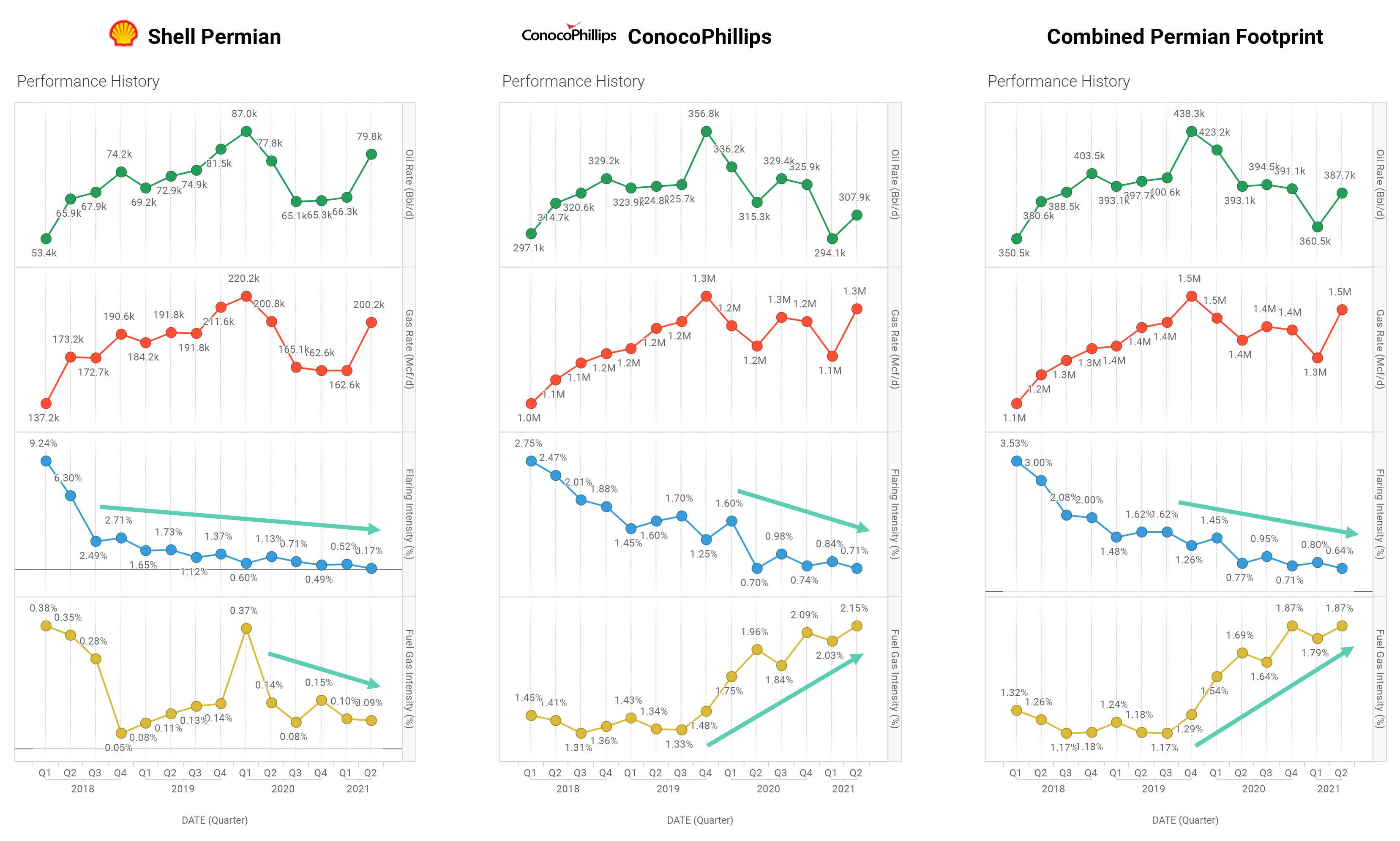

What does the combined footprint look like? The combined footprint places ConocoPhillips in the Top 2 spot in Permian operated production, lowers the overall GOR, and improves on Flaring and Fuel Gas Use metrics.

ConocoPhillips to buy Shell Permian assets for $9.5 Billion

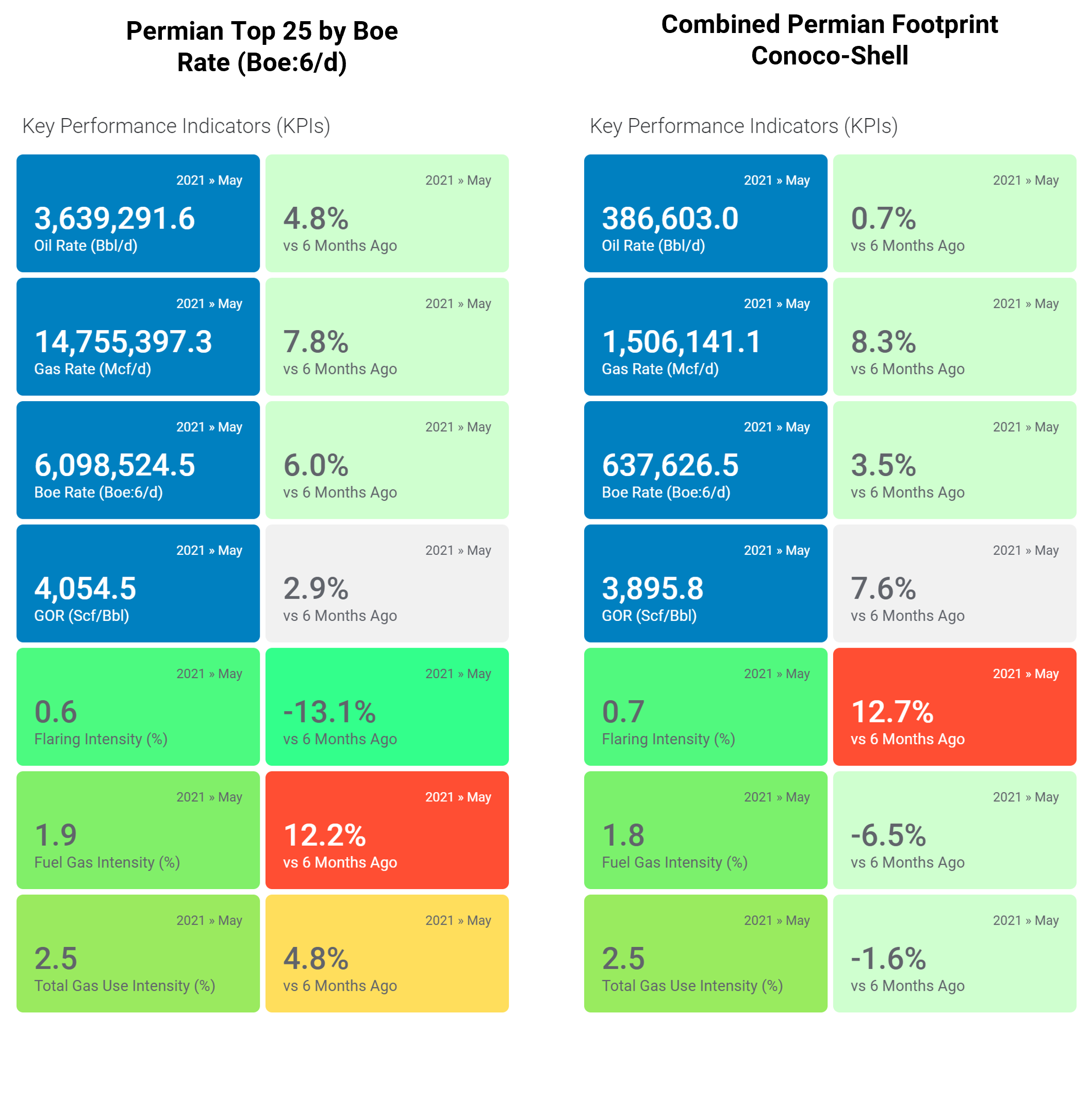

The combined operated production (Boe:6/d) puts ConocoPhillips in 2nd place in the Permian Basin after Pioneer.

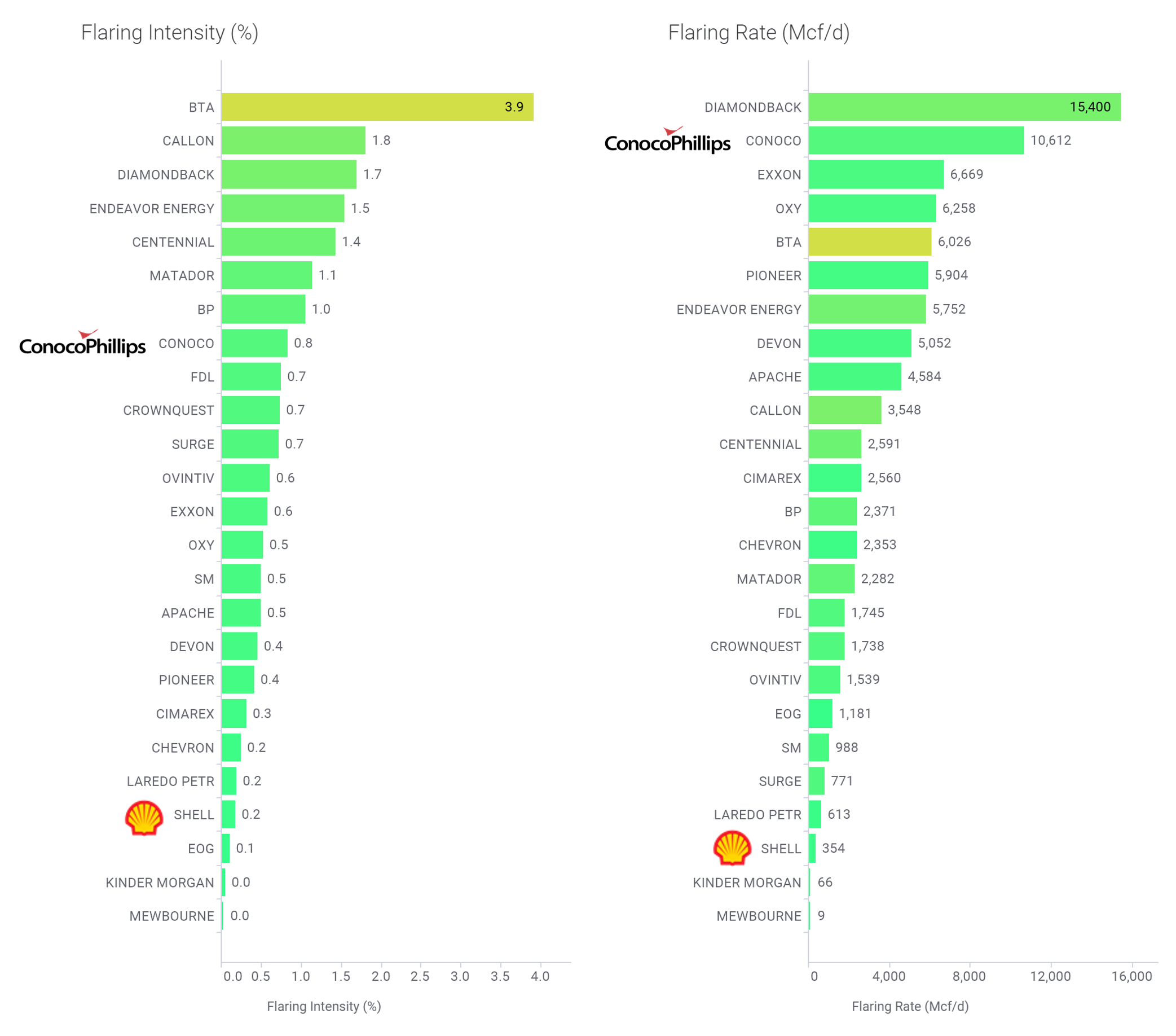

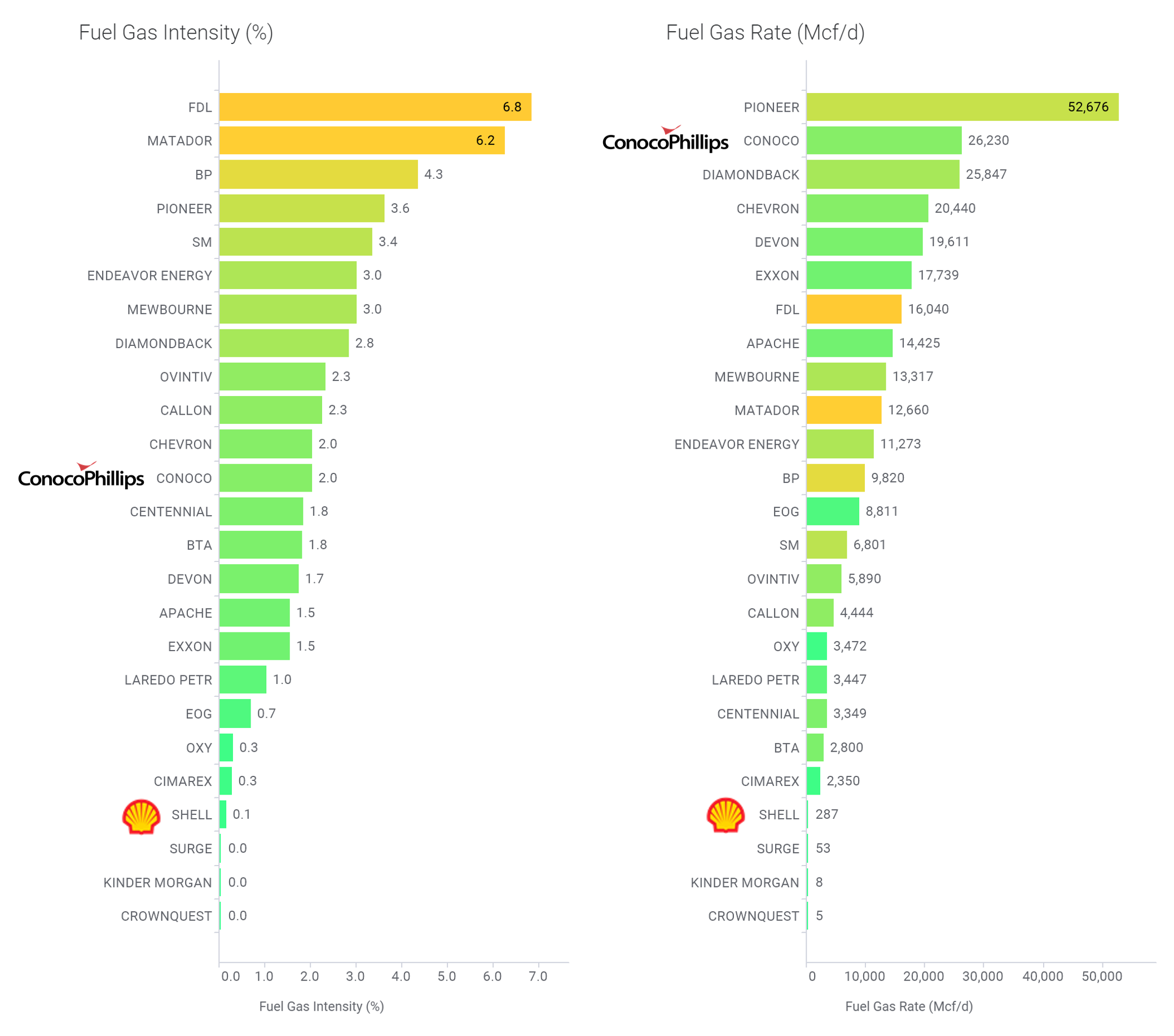

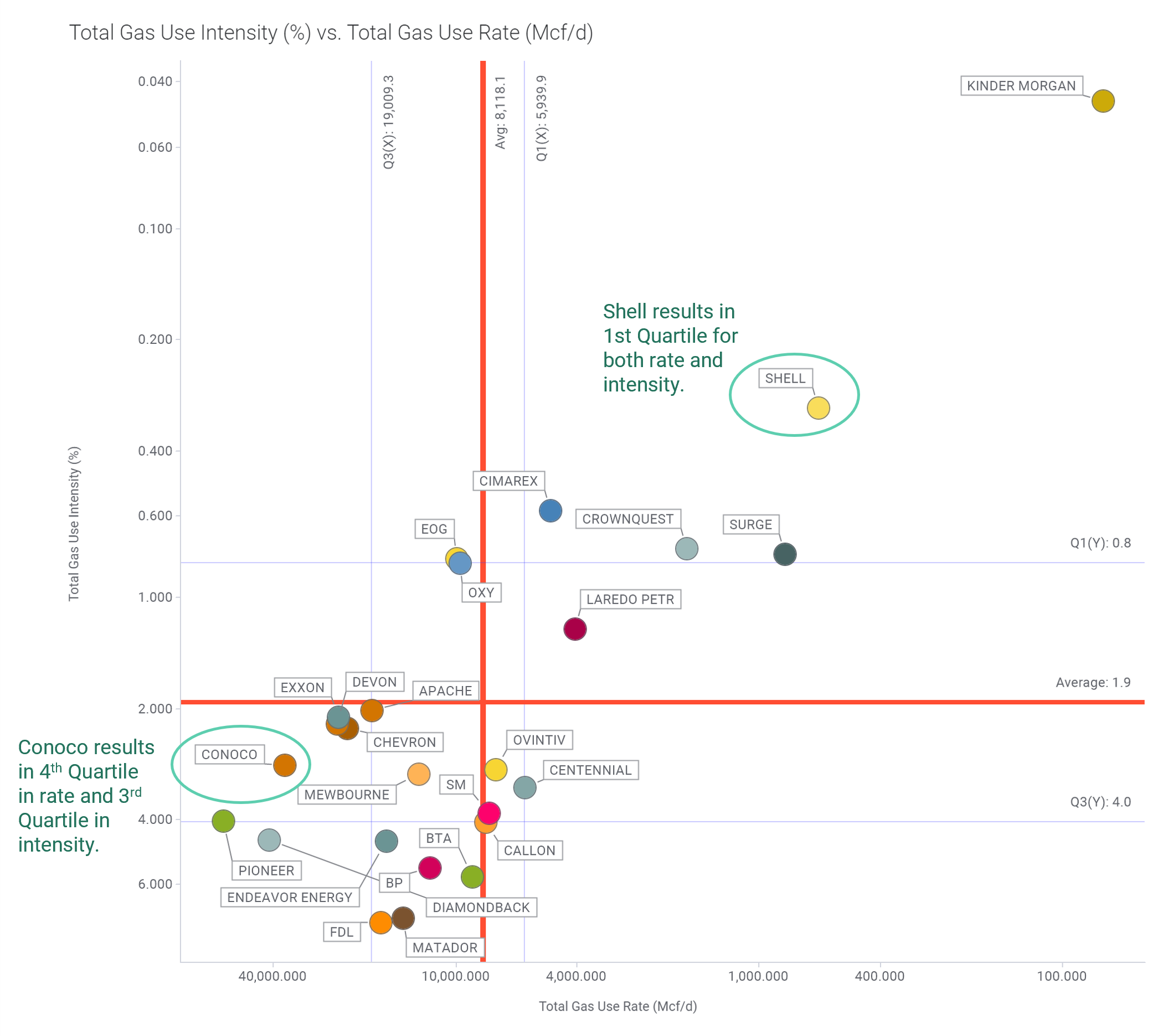

Shell and ConocoPhillips environmental performance relative to a Permian peer group of top 25 producers

Shell’s flaring intensity is at 0.17% vs. ConocoPhillips at 0.82% (or 79% lower). Both operators have made progress in this space and below Permian Basin aggregate intensity of 1.1% as of May 2021.

Gas flaring continues to be an area of focus and a crucially important metric as gas flared leads to emissions without useful energy delivery, especially if done for purposes other than safe oilfield operations.

Shell’s fuel gas intensity is at 0.14% vs. ConocoPhillips at 2.02% (or 93% lower). Both operators have also made progress here and below Permian Basin aggregate intensity of 2.04% as of May 2021, though ConocoPhillips is right at the mark.

Fuel gas use may be an indicator of various operations related power needs. One of the areas of required continued focus is the electrification of the oilfield, though challenges persist in grid availability and reliability. Centralized electrification leads to lower emissions and a lesser surface footprint. Though the gas is combusted vs. flared, the emissions profile is still significant. This makes it an important environmental metric to track, and as it relates to operator Scope 1 emissions.

The deal combined Permian footprint improves ConocoPhillips environmental metrics

The Combined Permian Footprint lowers ConocoPhillips Flaring & Fuel Gas Intensity closer to Peer Aggregate. Both operators made progress on reducing emissions related to these metrics, though ConocoPhillips increased fuel gas use over the last 7 quarters while Shell continued to reduce.

The Permian top 25 producer group accounts for 82% of basin-wide operated production – Our view on KPIs

Total Gas Use combines Flaring and Fuel Gas volumes into a single metric. This XY chart plots intensity vs. rate and divides the visualization into quartiles for the Permian Top 25 producers.

NOTE: Data in this report is current as of May 2021 and based on gross operated leasehold volumes.