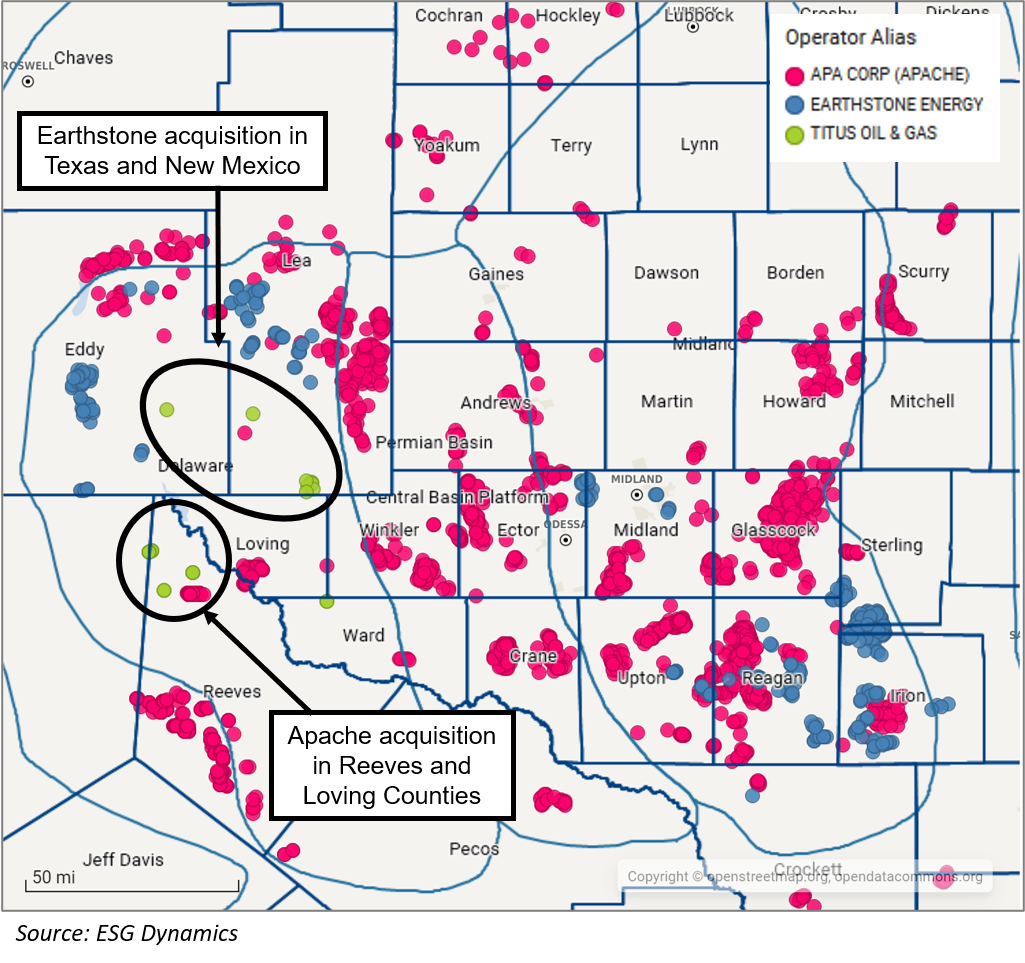

Earthstone Energy acquired NGP-backed Titus Oil & Gas in August, as part of its ongoing Permian Basin growth strategy. The $627 million cash plus stock deal brings 7,900 net acres in the northern Delaware Basin, 3 active rigs and 31,800 Boe/d production to Earthstone’s portfolio. The deal follows its first quarter purchases of Bighorn Permian Resources and Chisholm Energy for a combined $1.46 billion.

Titus spun off its Reeves and Loving County assets to Apache, for $505 million According to Reuters. The new properties could add about 13,000 Boe/d production by year end.

The two new owners plan to ramp up production rates through new drilling. A growing asset base with higher production levels can also mean growing greenhouse gas (GHG) emission profile. How will the acquisitions affect the two buyers’ environmental footprints?

Integrating new oil and gas assets involves more than drilling additional wells. New owners should evaluate field operations and equipment for environmental impacts. Detailed data is essential to identify leases with excessive flaring or to develop strategies that address high greenhouse gas emissions sources.

Opposite flaring trends

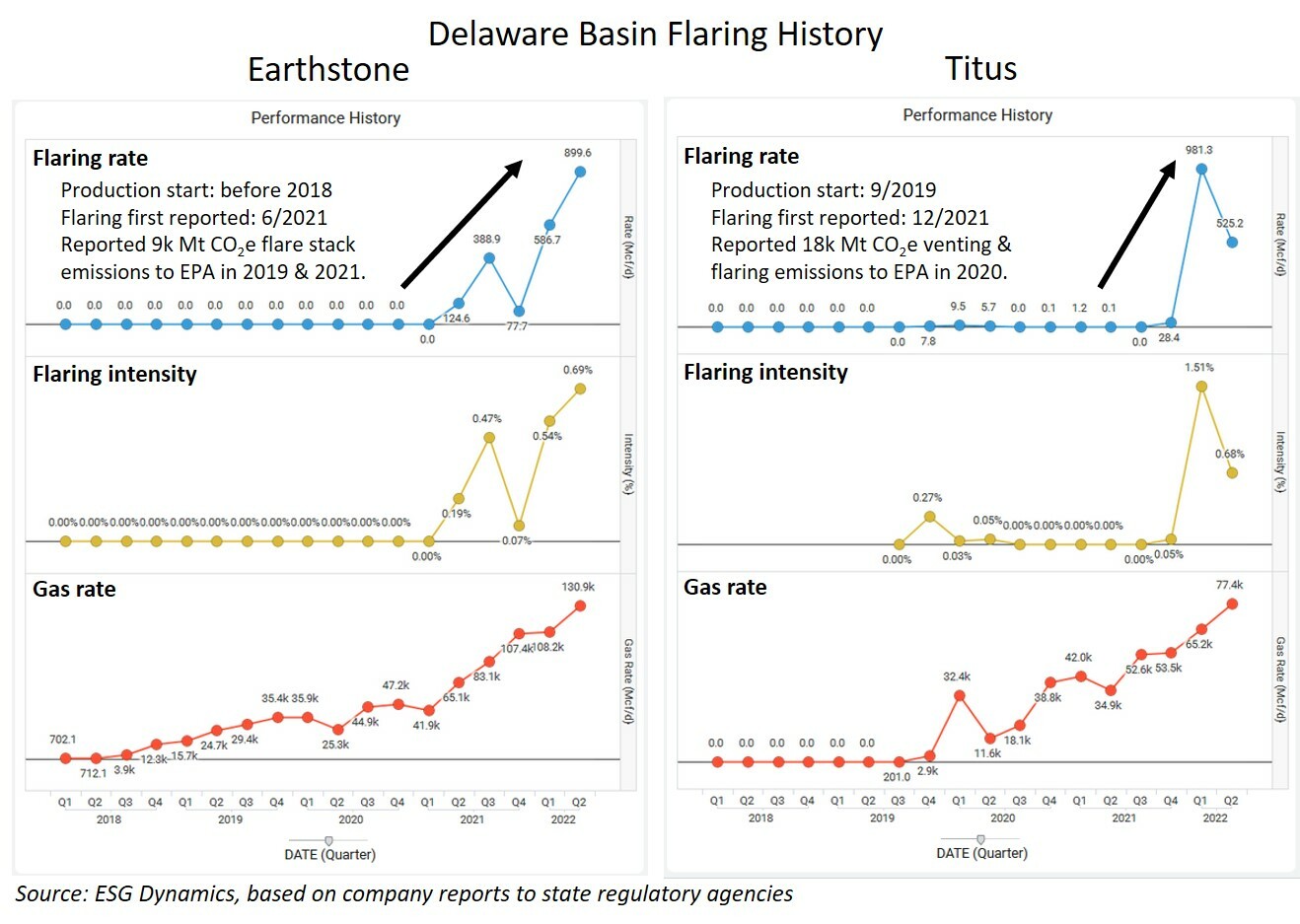

Delaware Basin flaring intensity is low for all three operators in the Titus transactions. In early 2022, all flared less than 1% of produced gas, which is the current benchmark for good ESG performance. But trends are heading in different directions on the Texas vs New Mexico assets.

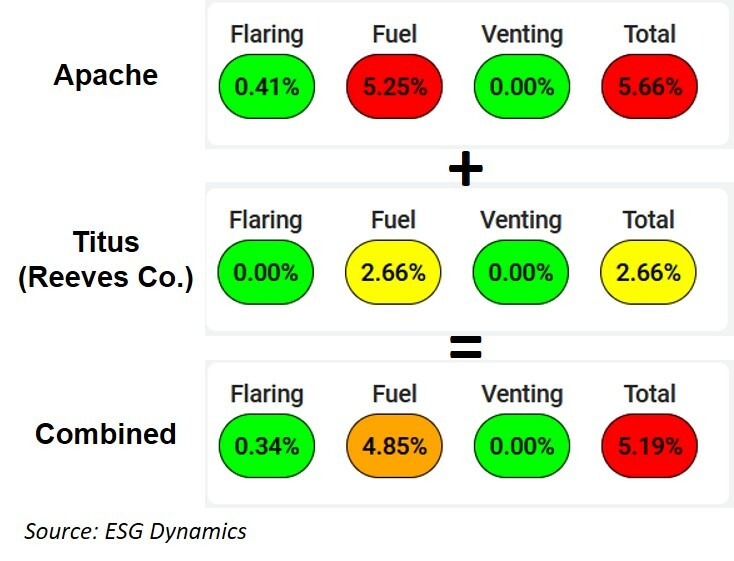

Apache has driven down Delaware Basin flaring since 2018, in terms of absolute rate and intensity. Before gas pipeline bottlenecks were relieved in Q3 2019, Apache’s flaring intensity exceeded 10% of produced gas. The company now flares less than 1% since Q2 2020, primarily from Alpine High Field in Reeves County. Based on Texas Railroad Commission data, Titus does not flare on the assets that Apache acquired. Because the Titus tracts are small compared to Apache’s footprint, we expect no significant impact to the buyer’s ESG metrics.

Conversely, Earthstone and Titus both dramatically increased Delaware Basin flaring rates since 2021, as associated gas production rose. Neither reported flared volumes to the state before that, despite submitting data to the EPA for greenhouse gas emissions resulting from venting and flaring. In light of apparent non-reporting, current and historical flaring intensity could be greater than the data suggests., In addition to reversing the flaring trend, Earthstone should focus on environmental data reporting and regulatory compliance as it grows, because investors and lenders now emphasize transparent ESG metrics.

ESG Dynamics data analytics modules provide granular environmental data that operators like Apache and Earthstone can use to pinpoint trouble spots in their operations. While ESG ratings and sustainability reports give a broad view of performance, our detailed data feeds actionable plans to correct problems and reduce greenhouse gas emissions.

More emissions from more sources

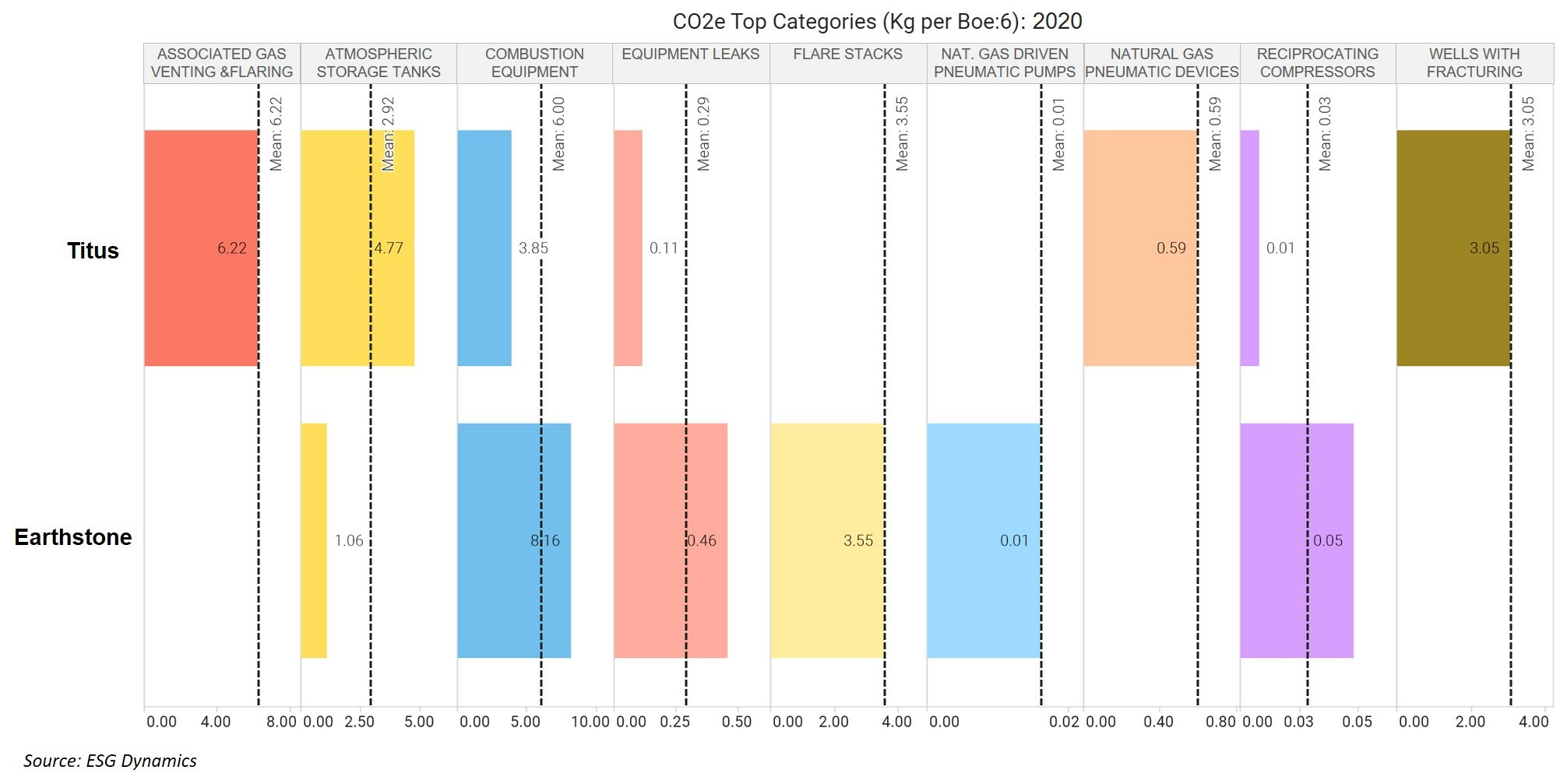

Titus’ greenhouse gas emissions are smaller than either new asset owner. Still, the acquisition will add 70% to Earthstone’s total emissions without any mitigating action.

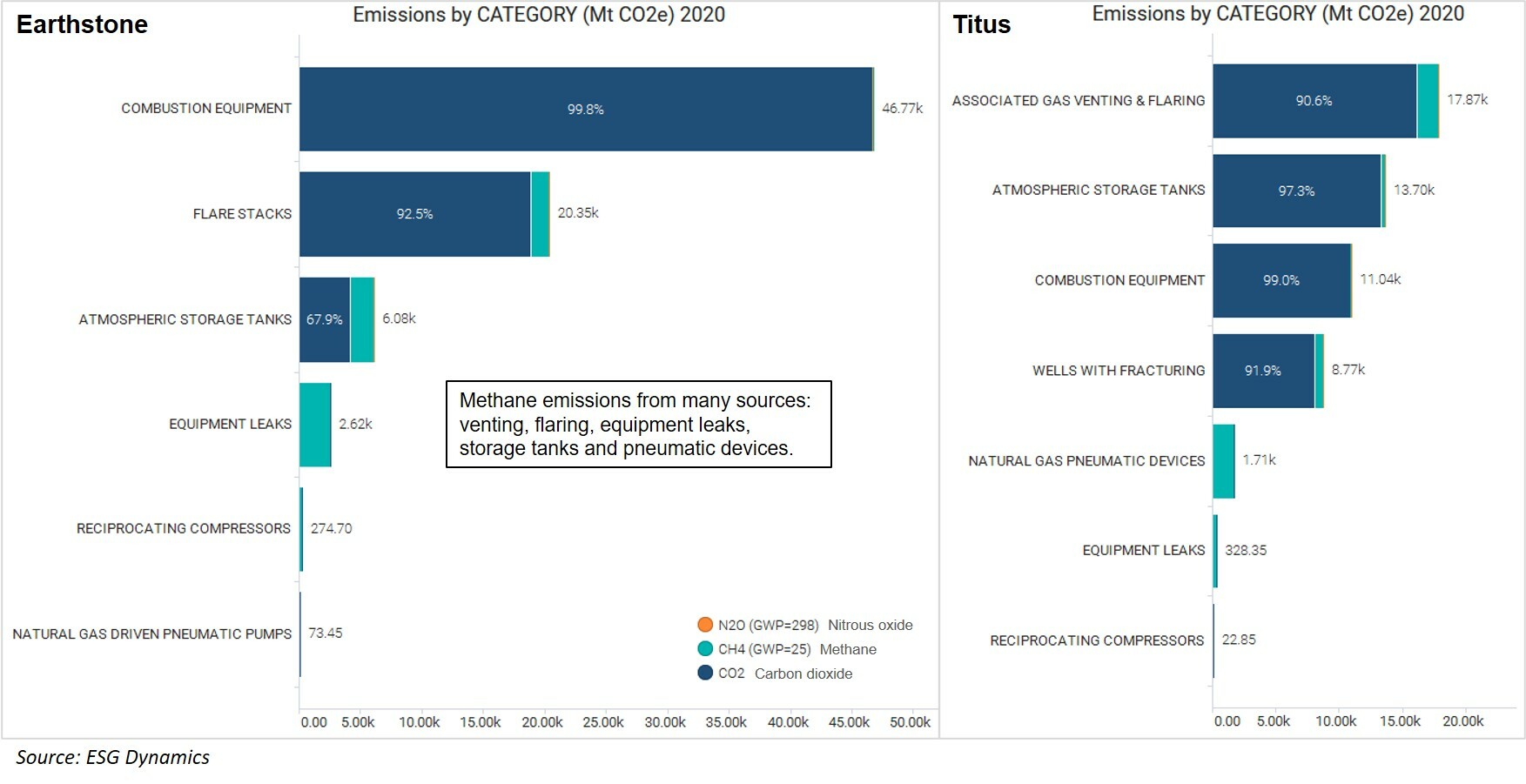

Earthstone faces a more complex environmental challenge following the Titus acquisition, because the emissions sources differ between operators. Overall, flaring and combustion equipment generated the highest emissions for both companies.

Other GHG sources require attention too. Notably Titus emissions from hydraulic fracturing could be reduced on future wells using Earthstone practices for emissions below recordable levels. Titus pneumatic devices emit 68 Mt methane (1.7k Mt CO2e), adding work to meet proposed new EPA guidelines for zero methane and VOC emissions. Earthstone may also need to improve the Titus storage tanks to keep CO2 emissions in check.

Greenhouse gas emissions are dominantly carbon dioxide, 91% for both Titus and Earthstone in 2020. Still, their operations contribute 448 Mt of methane (11.3k Mt CO2e) to the atmosphere from a variety of sources. Earthstone’s methane emissions steadily rose from 2018 to 2020, despite overall CO2e emissions reduction. Equipment leaks plus more flare stack and storage tank emissions caused the increase from 154 Mt/year to 258 Mt/year.

Get our take on your next deal

Contact us at info@esg-dynamics.com to learn about our oil and gas Environmental Advisory Practice. Or ask to see our environmental data analytics platform in action. We’re here to help with environmental compliance and environmental benchmarking, to quickly identify concerns so you’ll be ready for upcoming deals, capital raise or ESG messaging.